[Asia Economy Reporter Ji-hwan Park] Heungkuk Securities evaluated on the 27th that Heungkuk F&B showed significant growth in last year's performance.

Heungkuk F&B is a premium food and beverage development and manufacturing specialized company, producing fruit concentrates, coffee bases, food, and food and beverage original design manufacturing (ODM). Its excellent product lineup based on HPP technology is its greatest competitive advantage. HPP is an innovative technology that controls microorganisms under ultra-high pressure conditions, maintaining freshness without loss of the original taste, aroma, and nutrition of raw materials such as fruits, unlike conventional heating methods.

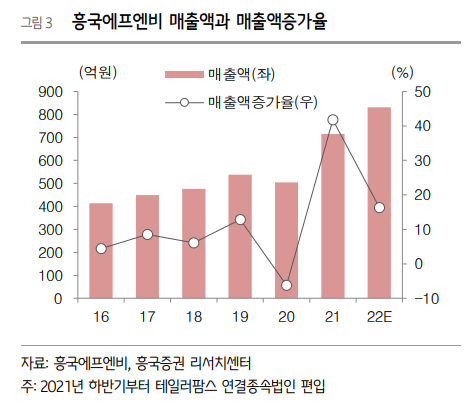

Last year, sales increased by 41.8% year-on-year to 71.5 billion KRW, and operating profit rose by 170.5% to 6.7 billion KRW. Both scale and profitability showed significant growth.

This was the result of stable performance of core products, favorable conditions in existing businesses due to expanded product composition of major clients, and strong performance of the subsidiary Taylor Farms. The main product groups include fruit concentrates such as grapefruit, lemon, and green grape, cold brew coffee bases, fruit and vegetable juices, and others (smoothies, desserts, bakery items, ODM coffee capsules, etc.). Major customers include Starbucks Korea (bottled beverages and seasonal beverage ingredients), Ediya Coffee (cold brew bases, blending teas), Emart (Peacock blended), SPC Group, and Twosome Place.

In particular, the acquisition of the high-quality subsidiary Taylor Farms is analyzed to have been effective. Taylor Farms is a prune food and beverage specialized company manufacturing and selling juices and dried products made from prunes (Western plums). It is the Korean branch of the 100-year-old American Taylor Brothers Farms and was acquired and incorporated in July last year. Researcher Kyung Choi of Heungkuk Securities said, "This year, Taylor Farms is estimated to have sales of 25 billion KRW and operating profit of 3.7 billion KRW as a high-quality subsidiary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.