Korea Institute of Machinery and Materials, Outlook for the 24th

On the 6th, workers are working in the Mullae Machinery and Metal District in Yeongdeungpo-gu, Seoul. The Seoul Metropolitan Government is developing the Mullae Machinery and Metal Anchor Facility No. 2 to qualitatively advance the foundational industries that will serve as the basis for future new growth engine industries. Photo by Jinhyung Kang aymsdream@

On the 6th, workers are working in the Mullae Machinery and Metal District in Yeongdeungpo-gu, Seoul. The Seoul Metropolitan Government is developing the Mullae Machinery and Metal Anchor Facility No. 2 to qualitatively advance the foundational industries that will serve as the basis for future new growth engine industries. Photo by Jinhyung Kang aymsdream@

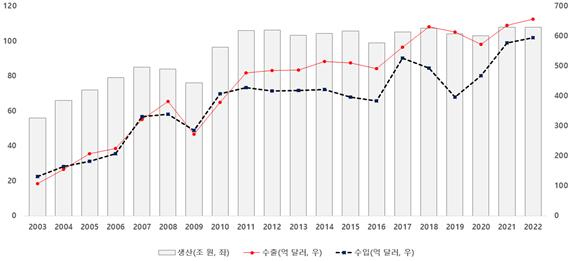

[Asia Economy Reporter Kim Bong-su] The domestic machinery industry is expected to grow by over 2% this year as well, following last year, recording a production value in the 110 trillion KRW range.

The Korea Institute of Machinery and Materials announced on the 24th that the domestic machinery industry's production value in 2022 is predicted to grow by over 2% compared to the previous year (108 trillion KRW), reaching around 110 trillion KRW. This forecast considers the continuous economic recovery trend, gradual resolution of global supply chain issues, and increased demand driven by the favorable conditions in front-end industries such as semiconductors.

Earlier, the manufacturing PMI surveyed in the fourth quarter of last year also projected a positive market outlook for early 2022. With the widespread distribution of COVID-19 vaccines and treatments, the economy is expected to continue recovering and maintain growth. However, uncertainties due to the spread of COVID-19 variants and geopolitical risks are anticipated to limit the growth rate.

In particular, this year, attention is focused on whether the machinery industry will sustain its growth as government policies on digital transformation, carbon neutrality, and housing stability are applied to the industrial sector. Semiconductor equipment, which has shown strong growth, is expected to continue driving the machinery industry's growth this year.

By sector, semiconductor equipment is expected to continue its growth from the previous year due to the ongoing boom in front-end industries. Machine tools and construction machinery, which showed remarkable performance in 2021, are also expected to maintain growth, though the extent is predicted to be limited.

Major institutions forecast that semiconductor equipment sales will grow by 11.2% to 22% in 2022, supported by steady investments from global chip makers. Researchers noted that while the effects of supply chain diversification in the Middle East, including Israel, have begun to appear, a strategic approach to technology security is necessary to respond to increased demand in front-end industries and semiconductor alliances among neighboring countries.

The display equipment sector is analyzed as needing policy measures to strengthen industrial competitiveness. The sluggishness in front-end industries due to COVID-19 and delays in restructuring the equipment industry centered on OLED are interpreted as causes for decreased exports and reduced capital investment by large corporations.

The plant and construction machinery sectors are expected to stabilize. Although the drought in large project orders in the plant sector is prolonged, LNG demand and liquefied plant orders are predicted to increase. The construction machinery sector is expected to grow slightly, led by exports, supported by expanded infrastructure investments for economic stimulus and the resumption of delayed projects.

Trends in Production and Trade of the Korean Machinery Industry and Outlook for 2022. Provided by Korea Institute of Machinery and Materials

Trends in Production and Trade of the Korean Machinery Industry and Outlook for 2022. Provided by Korea Institute of Machinery and Materials

The machine tool industry saw all major demand sectors increase by at least 30% in 2021, with both domestic and export markets rising sharply by over 60%. Production and exports are expected to increase, supported by the global economic recovery, but growth is anticipated to be limited due to uncertainties in the Chinese economy and high performance in the previous year.

Regionally, the Seoul metropolitan area was the only region where the production index stagnated, but exports increased centered on semiconductor equipment along with the Chungcheong region, while the Southeast region saw only a slight rebound due to sluggishness in its main industry, the automotive sector.

Kim Hee-tae, Senior Researcher at the Machinery Technology Policy Center of the Korea Institute of Machinery and Materials, said, “The machinery industry in 2022 is expected to grow slightly, supported by increased demand in front-end industries and the resolution of supply chain issues. However, to maintain leadership in the display equipment industry, a swift industrial restructuring centered on OLED is necessary.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)