'3rd Year of Corona' Distribution Industry Focuses on 'Contactless' and 'Fast Delivery'

Platform Integration and Expansion... M&A and Trillion-Won Investments Bear Fruit This Year

As the retail industry enters its third year of the COVID-19 pandemic, alongside "contactless" services, "fast delivery" has emerged as a key focus, prompting traditional retailers to concentrate on the last 1.6 km to consumers, known as the "last mile" competition. While expanding platforms to places easily accessible to consumers, companies are actively engaging in mergers and acquisitions (M&A) and investing trillions of won in logistics to reduce delivery times down to the minute.

According to industry sources on the 21st, SSG.com’s dawn delivery service will join Naver in the first quarter to broaden consumer touchpoints. Following last year’s integration of Emart’s SSG Delivery and Traders Mall, all direct delivery services can now be ordered through Naver as well. Gmarket, which was incorporated into the Shinsegae Group, will also launch a dawn delivery service next month. To expand direct delivery channels that can deliver orders in as fast as three hours and to handle this quickly, large-scale investments are underway. Emart is expanding the role of its stores as delivery bases by increasing the number of large picking and packing (PP) centers from seven last year to 31 this year. To strengthen logistics for "emergency shopping," two additional online-only logistics centers will be secured by the end of this year, with an investment of 1 trillion won planned by 2025.

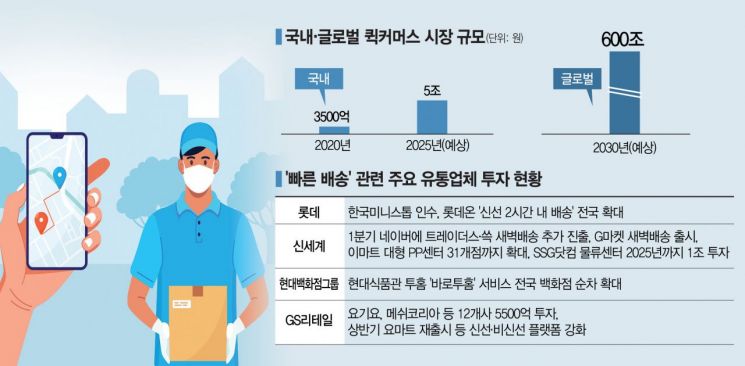

Major M&As in the retail industry are also linked to fast delivery. Last month, Lotte Group acquired Korea Ministop, which operates over 2,600 stores, at a higher-than-expected price (313.3 billion won) to increase the number of convenience stores nationwide, including 7-Eleven, to about 14,000 stores, thereby enhancing local market capabilities and expanding "quick commerce (immediate delivery) frontline hubs." Lotte On, Lotte Shopping’s integrated mall, plans to double the number of stores capable of delivering fresh food within two hours to about 50 nationwide this year. To achieve this, major Lotte Marts nationwide will be utilized like small to medium-sized logistics centers.

GS Retail invested 550 billion won last year in 12 companies including Yogiyo and Mesh Korea, and plans to concretize and launch its business this year. In the first half of this year, GS25, GS The Fresh, and about 16,000 retail stores will be linked with the Yogiyo platform to introduce a new service focused on fast delivery. CJ Olive Young is also expanding the use of its nationwide stores as logistics hubs. The "Oneul Dream" (Today’s Dream) service, which offers delivery within three hours and was first introduced in 2018, surpassed 1 million orders in Seoul last year, establishing its position. Hyundai Department Store plans to sequentially expand the "Baro To Home" service, currently offered through its food specialty online mall Hyundai Food Hall To Home, to department stores nationwide. Currently, through about 10 stores, orders placed within approximately 3 km are delivered within 15 to 30 minutes, offering food from famous restaurants.

The industry expects the domestic quick commerce market, which was about 350 billion won in 2020, to grow to 5 trillion won by 2025. The global quick commerce market is projected to reach approximately $508 billion (about 600 trillion won) by 2030. Experts believe that as the success formula for retail changes, competition for market dominance will remain fierce for the time being. Professor Seo Yong-gu of the Department of Business Administration at Sookmyung Women’s University said, "With a vast number of products and improved quality, the core of competition has become fast and safe delivery. Even after COVID-19 ends, customers will not revert to old habits, and a consensus has formed that companies excelling in last mile services will survive, so investments related to the last mile will continue even if they are not immediately profitable."

However, there are voices cautioning against focusing solely on fast delivery in the immediate term. Jung Yeon-seung, president of the Korea Distribution Association, pointed out, "If fast delivery itself becomes an excessive competition, there will come a time when it returns to an appropriate level. The essential competitiveness such as product sourcing, pricing, and private brand (PB) products should not be overlooked."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)