- If Next-Generation Payments Such as Biometric Authentication Are Activated, 1.3 Trillion Won in Social Opportunity Costs Will Be Saved

- Korea's Payment Market Level Trails the US and China

Global management consulting firm Boston Consulting Group (BCG) Korea released a report titled "Future of Spending 2022 - Closer to the Essence of Transactions - Redefining Payments," analyzing that the current payment methods cause an annual opportunity cost loss of 2.7 trillion KRW in South Korea. They forecast that activating next-generation payments such as biometric-based payments could reduce these opportunity costs and bring economic, social, and technological benefits. Furthermore, while the United States and China are already actively utilizing biometric-based payments, South Korea is lagging behind in advanced payment methods. To quickly catch up in the payment sector, BCG suggested that institutional support from the government and regulatory authorities is essential.

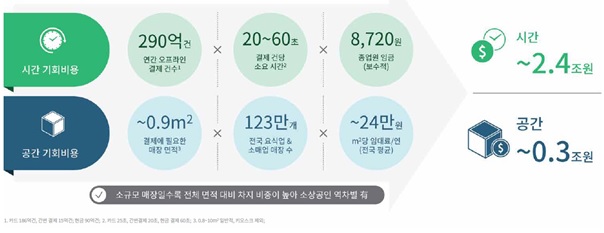

According to BCG's analysis, approximately 290 million hours and 1.107 million m² of space are used annually in the domestic market for the procedure of "payment" offline using cards and cash. When converted into monetary value, an annual opportunity cost of 2.7 trillion KRW is socially wasted due to the current payment methods.

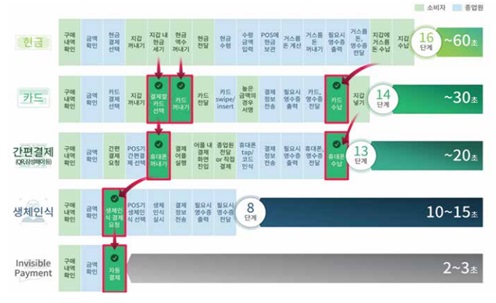

To minimize the opportunity costs caused by payments, BCG recommended the activation of biometric-based payment systems that allow payments anytime and anywhere without carrying separate media such as cash, cards, or mobile devices. BCG estimated that introducing biometric payments would reduce the time spent on card and mobile simple payments from 20-30 seconds to around 10 seconds. As a result, it is analyzed that 270 million hours annually in the total offline payment process in South Korea could be saved, which translates to a social opportunity cost saving of about 1.3 trillion KRW.

BCG pointed out that South Korea is lagging behind in utilizing biometric-based payments. The United States and China are leading the related industries. In the U.S., new payment methods such as PopID based on facial and vein recognition, Amazon One, and Amazon Go, where payments are automatically processed upon leaving the store, are continuously being developed and commercialized. In China, 90% of smartphone users utilize mobile payments, and biometric payments are actively used in various consumption areas such as restaurants and supermarkets. In contrast, South Korea still primarily uses cards as the main payment method.

BCG stated that for a new biometric-based payment ecosystem to take root domestically, efforts to create an environment such as providing relevant guidelines by the government and regulatory authorities are essential. Additionally, for domestic suppliers like fintech companies to attempt innovations such as biometric-based payments, clear legal foundations and guidelines, including the Electronic Financial Transactions Act (EFT Act), must be promptly established.

Park Young-ho, Partner at BCG Korea, said, "Biometric payments are already gaining attention as next-generation payment methods, especially in the U.S. and China," adding, "It is important to establish an institutional foundation that allows domestic companies to adopt new payment methods without hesitation or to attempt expanding their current simple payment businesses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)