Variable Mortgage Rates 3.58~5.23%

Mixed Mortgage Rates 3.600~4.978%

Due to COFIX Increase and Rising Bank Bond Yields

Expected to Keep Rising with Additional Base Rate Hikes

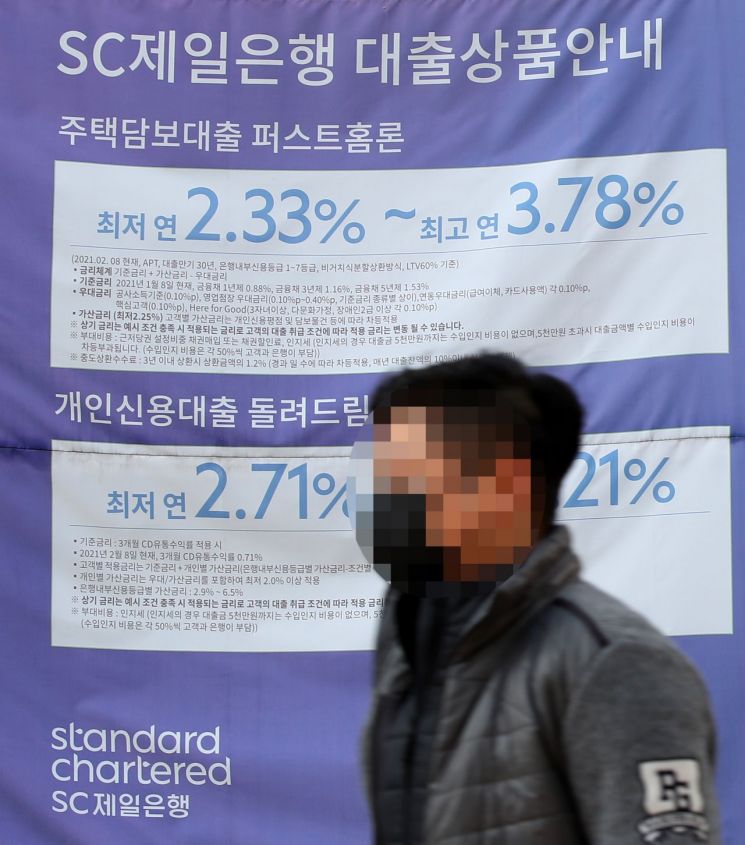

[Asia Economy Reporter Sim Nayoung] Bank loan interest rates are rising sharply. The burden on the 'Youngkkeuljok' (those who borrow every possible means, even their soul, to buy a house), who bought homes using all available funds including loans and spare money, is expected to snowball.

According to the financial sector on the 13th, the variable interest rates for mortgage loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) (as of the 10th, linked to the new COFIX) are at 3.58% to 5.23% per annum. Compared to the end of last year (3.71% to 5.07%), this is an increase of 0.13 to 0.16 percentage points. The COFIX (Cost of Funds Index), which is the benchmark for variable mortgage loan rates, rose to 1.69% on the 17th of last month, up 0.14 percentage points from the previous month (1.55%).

COFIX is an indicator showing how much cost (interest rate) eight domestic banks incurred to raise funds for loans. It reflects changes in interest rates of deposit products such as savings and time deposits, and bank bonds. Savings and time deposits account for 70 to 80% of the total.

During the same period, the mixed (fixed) mortgage loan interest rates rose from 3.600% to 4.978% to 4.060% to 5.770% per annum. The lowest rate increased by 0.460 percentage points, and the highest rate by 0.792 percentage points. This is because the 5-year bank bond (AAA, unsecured) rate, used as an indicator for fixed mortgage loan rates, surged from 2.259% to 2.725%, an increase of 0.466 percentage points.

The January COFIX, to be announced on the 15th, is also expected to rise further. After the Bank of Korea raised the base interest rate by 0.25 percentage points on the 14th of last month, commercial banks also raised deposit interest rates by up to 0.3 percentage points. If the January COFIX exceeds 1.70% due to this influence, banks will follow the step of raising variable mortgage loan interest rates further.

The pace of interest rate increases is expected to accelerate. The U.S. Federal Reserve, the central bank, is expected to raise the base interest rate up to five times this year to curb inflation, and the Bank of Korea is also expected to raise rates two to three times. If the base interest rate rises twice (0.5 percentage points) within this year, it is predicted that mortgage loan interest rates could rise to the mid-6% range simply by reflecting the base rate increase. If the Bank of Korea raises rates three times (0.75 percentage points), rates could rise to the high 6% range. As loan interest rates rise, borrowers will have to pay more interest, increasing their repayment burden.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.