Consumer Pays 18,000 Won, Business Owner's Account Shows 9,700 Won

Delivery Fee 5,000 Won, VAT Excluded... Effectively 5,500 Won

Customer-Facing Delivery Tip Displays 'VAT Included' Price

"Delivery Platforms Are Causing Confusion for Self-Employed," Criticism Raised

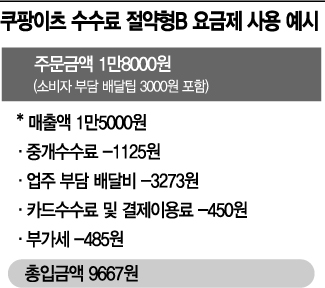

# Baek, who runs a restaurant in Mapo-gu, Seoul, recently experienced a significant drop in profits after Coupang Eats ended its single-order delivery discount event and introduced the ‘commission-saving fee plan.’ For each delivery generating 15,000 KRW in sales, only about 9,700 KRW was deposited into Baek’s bank account. Considering that the consumer actually paid 18,000 KRW including the delivery tip, over 8,000 KRW went to Coupang Eats and the delivery rider. On top of this, Baek sighs under the burden of having to pay value-added tax (VAT) amounting to 10% of costs such as brokerage fees, card payment fees, and delivery charges.

From the beginning of the new year, self-employed business owners struggling with rising delivery fees are facing even more headaches due to various VAT charges. As commission rates have increased, the VAT burden has also grown. The delivery industry’s practice of showing ‘VAT included’ on delivery tips paid by consumers and ‘VAT excluded’ on delivery fees paid by business owners has also been criticized as problematic.

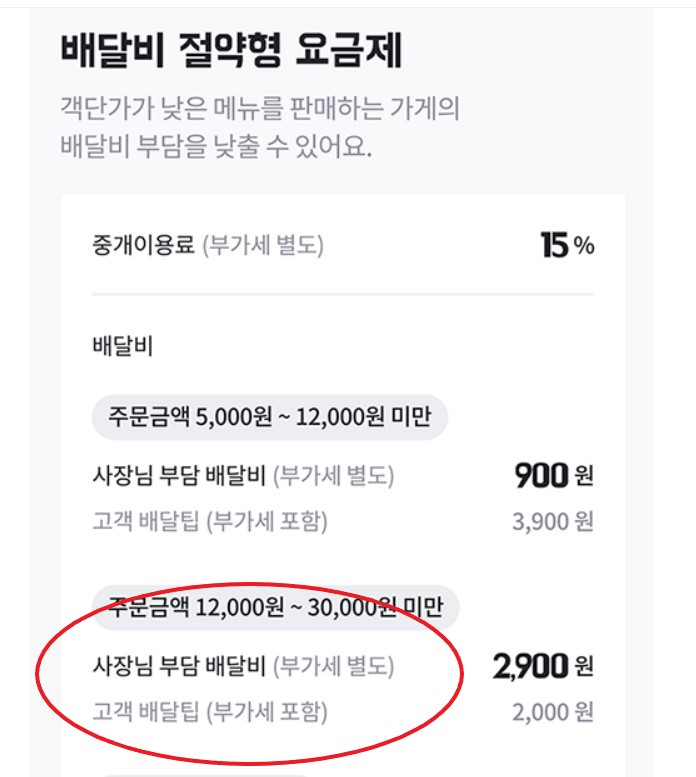

According to the industry on the 11th, as major delivery platforms like Baedal Minjok and Coupang Eats sequentially ended their single-order delivery service discount events, the delivery fee burden on partner businesses increased. Coupang Eats revamped its fee plans on the 3rd and allowed Seoul-based partner businesses to choose from four types of fee plans. Baedal Minjok also diversified its Baemin1 single-order delivery service into various plans, including the basic plan (brokerage fee 6.8%, delivery fee 6,000 KRW), a delivery fee-saving plan, and an integrated plan.

Until now, store owners and consumers could use single-order delivery cheaply thanks to promotional prices of 1,000 KRW brokerage fee and 5,000 KRW delivery fee per order. Although delivery platforms diversified their fee plans with names like ‘saving type’ and ‘customized type’ after ending promotions, increases in commissions and delivery fees became inevitable.

As the costs that business owners must pay for using single-order delivery services increase, the VAT burden has also grown accordingly. Delivery fees are divided into ‘delivery tips’ paid by consumers and ‘delivery charges’ paid by business owners. When announcing fee plans, delivery platforms indicate to business owners that the total delivery fee is ‘VAT excluded,’ while the delivery tip is shown as ‘VAT included.’ This has led to complaints that it causes confusion among self-employed business owners.

For example, when promoting a fee plan to a business owner, the stated delivery fee of 5,000 KRW is a VAT-excluded amount, and the actual delivery fee including 10% VAT (500 KRW) is 5,500 KRW. If a consumer pays a delivery tip of 2,000 KRW, this includes a supply price of 1,818 KRW plus 182 KRW VAT. The business owner pays VAT of 318 KRW on the 3,182 KRW balance after subtracting the consumer’s portion of 1,818 KRW from the 5,000 KRW delivery fee. This results in a higher delivery charge burden than initially expected.

When it is difficult to secure delivery riders, various surcharges apply, and VAT must be paid additionally on these as well. For example, if the rain surcharge is 500 KRW, an additional 50 KRW VAT is charged. Furthermore, Coupang Eats’ commission-saving fee plan limits the consumer’s delivery tip to a maximum of 4,000 KRW, leading to criticism that it “increases the burden on business owners while trying to prevent customer churn.”

Woowa Brothers, the operator of Baedal Minjok, explained, “Notifying VAT separately is standard in business-to-business (B2B) contracts where VAT is contracted separately, to make the store owners’ awareness of commission fees clearer. Usually, when consumers purchase products, they pay the amount including VAT, so customers are notified with VAT included.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.