[Asia Economy Sejong=Reporter Kim Hyewon] From this year, the fuel cost support amount for compact cars has increased to 300,000 KRW.

The National Tax Service announced on the 10th that the annual fuel cost support limit has been raised from 200,000 KRW to 300,000 KRW for owners of one compact car per household who purchase fuel using a fuel purchase card.

This is the first time in five years that the government has raised the compact car fuel tax refund limit since 2017 (from 100,000 KRW to 200,000 KRW).

Since 2008, the government has operated a compact car fuel tax refund system under the Restriction of Special Taxation Act to encourage energy saving and reduce the fuel cost burden on low-income households. The application period for this special tax provision has been extended until the end of next year.

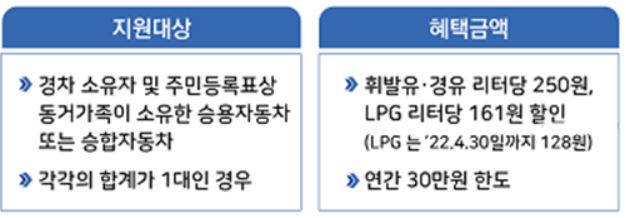

Owners of one compact car per household (engine displacement under 1000cc) receive a refund on the fuel tax included in the fuel price (250 KRW per liter for gasoline and diesel) up to an annual limit of 300,000 KRW.

When compact car owners obtain a fuel purchase card and buy fuel for their compact cars, the refund amount is deducted from the card payment, so there is no need to apply separately for the refund. The fuel purchase card can be applied for from only one of the following card companies: Lotte, Shinhan, or Hyundai Card. Issuance of one card per person is the principle.

The fuel purchase card cannot be used for vehicles other than the eligible compact cars. If the fuel purchase card is used by another person or for another vehicle, a 40% additional tax will be imposed along with the fuel tax, and the compact car owner may be excluded from the fuel cost support program.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.