Securing the 'Convenience Store = Wine' Position Amid Competition with Large Supermarkets

[Asia Economy Reporter Lim Chun-han] As the domestic wine market rapidly grows, competition among distributors is intensifying. Convenience stores are aggressively expanding liquor specialty stores centered on wine, entering full-scale competition with large supermarkets. This is interpreted as a move to dominate the wine market following convenience store sales surpassing those of large supermarkets for the first time last year.

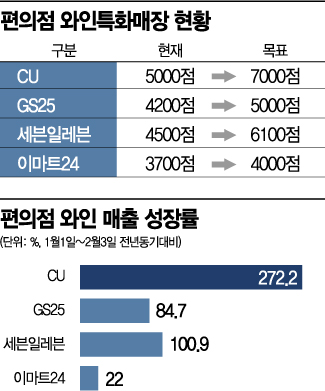

On the 7th, CU operates about 5,000 wine specialty stores and aims to expand to 7,000 stores within the year. They handle around 200 types of wine. GS25 has about 4,200 wine specialty stores, offering around 300 types of wine. GS25 plans to increase the number of wine specialty stores to 5,000 this year based on commercial district and sales data.

Seven Eleven plans to expand its wine specialty zones from the current 4,500 stores to 6,100 stores. The number of wines sold is about 120 types, with products ranging in price from 4,500 KRW to 1.8 million KRW. Emart24 will increase its liquor specialty stores from about 3,700 to 4,000 stores. They sell around 200 types of products including wine and whiskey.

Convenience store wine sales continue to show explosive growth. At CU, wine sales from the 1st of last month to the 3rd of this month increased by 272.2% compared to the same period last year. GS25, Seven Eleven, and Emart24 also saw increases of 84.7%, 101.9%, and 22.0%, respectively.

Convenience stores are also strengthening mobile ordering services. Customers order wine through applications (apps) and pick it up at their desired store, leveraging the fact that online alcohol sales are prohibited as a new competitive advantage. CU’s wine shop sales increased by 193.0% year-on-year from the 1st of last month to the 3rd of this month. Customers can purchase about 100 types of wine, ranging from cost-effective wines priced between 10,000 and 20,000 KRW to premium wines priced at 1.5 million KRW.

During the same period, GS25’s Wine25 Plus sales grew by 405% compared to the previous year. The regional sales distribution was 30% in Seoul, 27% in Incheon and Gyeonggi, 17% in the Gyeongnam area, 12% in the Chungcheong area, and 10% in the Honam area. As the number of users of this service increased, the number of products expanded from about 400 to over 5,000. At Seven Eleven, wine reservation orders through the app increased by 52.5%, and at Emart24, they increased by 240%.

An industry insider from the convenience store sector said, "The introduction of mobile ordering services has enabled convenience stores to handle numerous wines, whiskeys, and more," adding, "It is growing into a core service that enhances customer satisfaction by improving purchase convenience while generating additional sales for franchise stores."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.