Increased Demand for Proactive Fundraising

Challenges for Low Credit Rating Companies

[Asia Economy Reporters Sohyeon Park and Jihwan Park] In January of this year, the issuance amount of corporate bonds (SB) by domestic companies recorded an all-time high. As concerns grew that the Bank of Korea's interest rate hike trend would continue, demand to proactively raise funds while interest rates were still relatively low increased significantly. However, as large institutional investors concentrated their corporate bond investment demand on high-quality companies, firms with relatively lower credit ratings are facing difficulties in raising funds.

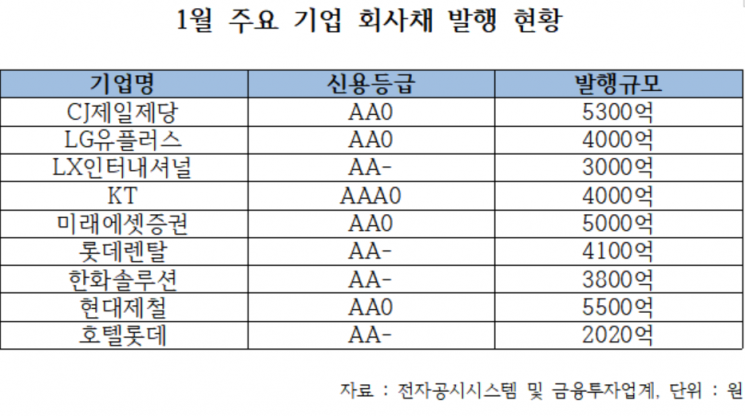

According to the investment banking (IB) industry on the 4th, the amount of SB issued by domestic companies up to the end of January this year was 7.72 trillion KRW. This is the largest scale since January 2019, three years ago, when it recorded 6.7 trillion KRW. By group, Hyundai Motor Group had the largest bond issuance volume. Hyundai Steel issued 550 billion KRW, and Hyundai Rotem issued 165 billion KRW in corporate bonds. Following them were LG Group, CJ Group, and Lotte Group in order of bond issuance volume. LG Uplus issued 400 billion KRW, LX International 300 billion KRW, CJ CheilJedang 530 billion KRW, CJ Freshway 100 billion KRW, Lotte Rental 410 billion KRW, and Hotel Lotte 202 billion KRW, among others.

Not only high-quality companies with credit ratings of AA or higher but also companies rated A and BBB issued corporate bonds. It is interpreted that companies judged it necessary to prepare proactively because the interest cost burden increases with rising interest rates, especially for those with relatively lower credit ratings. Hanwha, Hanwha Construction, Hanjin, and Kolon have issued or plan to issue corporate bonds. Capital companies also raised operating funds, leading to other financial companies' bonds, mostly capital bonds, reaching a record high of 5.8 trillion KRW.

However, raising funds was not smooth for all companies. In particular, polarization between high-credit-rated companies and low-credit companies intensified. Cases of unsold bonds or cancellations of issuance plans were detected among companies rated A or below, which have weak demand. Some companies with credit ratings below A, such as Hansol Paper and HDC Hyundai EP, canceled or postponed their corporate bond issuance plans last month. In the case of CJ Freshway, there was an unsold amount of 48 billion KRW out of the 100 billion KRW offering, and LS Cable & System secured only 30 billion KRW out of the 60 billion KRW 5-year bond offering. Researcher Kyungrok Lee of Shinyoung Securities said, "A-rated corporate bonds showed weaker investor sentiment compared to AA-rated or higher high-quality bonds and BBB-rated corporate bonds (high-yield funds) among institutional investors."

For AA-rated or higher bonds, stable credit ratings stood out, and for BBB-rated corporate bonds, institutional demand increased to receive allocations of public offering stocks. This is in preparation for large-scale initial public offerings (IPOs) this year, starting with LG Energy Solution, which was listed last month. Currently, only funds holding BBB-rated high-yield bonds can receive a 5% preferential allocation benefit of public offering stocks. Researcher Eungi Kim of Samsung Securities forecasted, "With large-scale IPOs of major companies such as Hyundai Oilbank scheduled in the first half of the year, the increase in high-yield fund setups and the expansion of BBB-rated investments are expected to continue to drive issuance growth through the first half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.