[Asia Economy Reporter Jeong Hyunjin] "Following last year's record high, the mergers and acquisitions (M&A) market will continue to be active this year."

U.S. investment bank Morgan Stanley predicted in its '2022 M&A Outlook' released last month that this year will also be a significant year for M&A. Although uncertainty remains high due to the COVID-19 pandemic, still-low interest rates and corporate demand have created a favorable environment for M&A. Rob Kindler, Morgan Stanley's Global Head of M&A, said, "The M&A environment remains strong this year because most of the key factors that drove last year's robust M&A market are still in place."

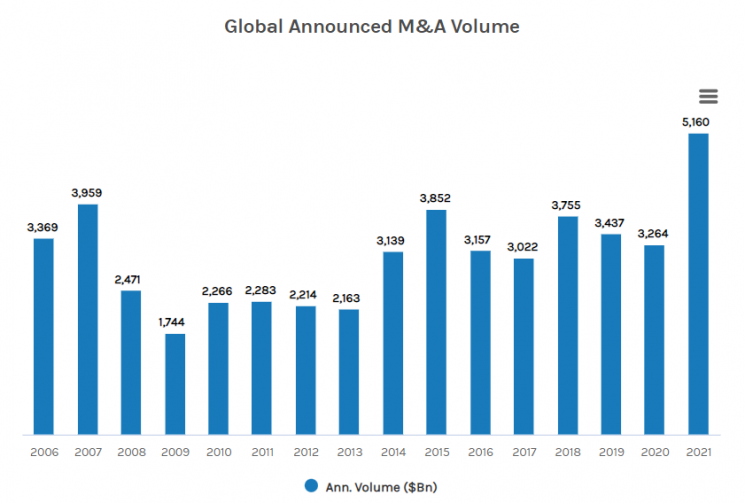

According to Morgan Stanley citing global financial information provider Refinitiv on the 1st (local time), M&A deals worth over $100 million last year totaled $5.16 trillion (approximately 6,251 trillion KRW). This is the largest amount ever recorded, representing a 58% increase compared to 2020, when the COVID-19 pandemic was at its peak, and more than a 30% increase compared to 2007 ($3.959 trillion), the highest level since 2006.

JP Morgan reported that the global M&A volume last year reached $5.9 trillion, setting a new record by expanding 28% compared to the previous high in 2007. About half of these deals were in the $1 billion to $10 billion range, and private company transactions accounted for $3.2 trillion, representing 54% of the total M&A market last year?the highest proportion in the past three years.

Although Morgan Stanley and JP Morgan showed some differences in the scale of the M&A market, both agreed that it surpassed the $5 trillion mark, setting an all-time high. Morgan Stanley analyzed that "companies accelerated strategic M&A last year," expanding the sectors and deal sizes and increasing access to new markets.

Both investment banks (IBs) expect the strong M&A market seen last year to continue this year. Morgan Stanley noted that while interest rate hikes, supply chain issues, and securing human resources could pose challenges to M&A, the solid economic fundamentals and anticipated global economic growth will keep demand for M&A high, leading to market expansion.

They particularly highlighted e-commerce, logistics, content delivery, consumer interfaces, and business infrastructure as priorities, with companies accelerating digital transformation, which is expected to have a significant impact. Conversely, sectors hit hard by COVID-19 such as travel, leisure, and aerospace are expected to have low M&A activity through this year but are projected to gradually recover toward the end of the year. Regionally, Morgan Stanley noted that large-scale M&A occurred mainly in the U.S., where economic recovery was rapid last year, and forecasted that this year, not only the U.S. but also Europe, the Middle East, and Asia will experience a booming M&A market.

JP Morgan mentioned that risks such as macroeconomic and capital market cycle uncertainties, the course of the COVID-19 pandemic, and ongoing supply chain disruptions will remain in the M&A market. However, they emphasized that companies strategically need M&A for innovation, technology, and growth. They added that M&A in technology, healthcare, and energy transition sectors will attract attention, and shareholder activism regarding ESG (Environmental, Social, and Governance) issues will also expand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)