[Asia Economy Reporter Park Jihwan] Hana Financial Investment evaluated on the 2nd that despite Shinsegae Food is expected to show a significant increase in performance this year, the current stock price level is undervalued, making a buying strategy valid.

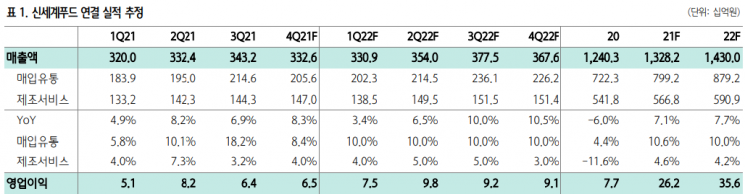

This year, Shinsegae Food's consolidated sales and operating profit are expected to increase by 7.7% and 35.9% year-on-year to 1.43 trillion KRW and 35.6 billion KRW, respectively. The profit contribution of the franchise business, composed of brand royalty and manufacturing margin, is estimated to rise from 19% last year to 27.5% this year.

Sim Eunju, a researcher at Hana Financial Investment, stated, "Since the franchise organization was newly established this year, we are putting considerable effort into it," adding, "Currently, the number of No Brand Burger stores is identified as 170, of which 117 are franchises, and it is estimated that at least 200 stores can be opened by the end of the year."

Researcher Sim said, "The domestic burger market size is estimated to have increased sharply by 34% year-on-year last year, and considering the number of competitor stores, there is still high potential for expansion," and "Considering that it took about two years to open 100 franchise stores, consumer awareness is also considered quite high." In particular, recently, Shinsegae Food released self-developed cola and cider at No Brand Burger stores, and it is expected that increasing sales per store through mid- to long-term category expansion will be possible.

Researcher Sim emphasized, "The current stock price corresponds to an expected price-earnings ratio (PER) of around 10 times this year, so the valuation burden is limited," and "Considering the performance momentum, a buying strategy is valid as the contribution of new business to performance is expected to increase significantly, recovering profit capacity to the 30 billion KRW level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)