FKCCI Analysis of 'Top 5 Risk Factors for the Korean Economy in 2022'

[Asia Economy Reporter Lee Hye-young] An analysis has emerged that to maintain the same economic growth in South Korea this year as last year, the country must prepare for commodity-driven inflation, monetary tightening by major countries including the United States, and a slowdown in China's growth.

The Federation of Korean Industries (FKI) announced on the 1st, through its report titled "Top 5 Risks to the Korean Economy in 2022," that it derived these conclusions after analyzing the risk factors facing the Korean economy this year.

First, the FKI expressed concern that the surge in global commodity prices could lead to domestic price increases, which in turn would raise export prices and potentially harm the Korean economy.

The Standard & Poor's (S&P) Commodity Index, which tracks international commodity price trends, rose sharply by 51% compared to early last year as of the 27th of last month. Steel prices also increased by about 56%, from 420,000 KRW per ton to 655,000 KRW, signaling warning signs for the manufacturing sector.

The FKI explained that such commodity price increases lead to deteriorating corporate profitability, and if the rise continues long-term, it inevitably triggers a chain reaction resulting in higher consumer prices.

Monetary policy tightening by major countries such as the United States could also negatively impact the Korean economy.

Central banks of major countries have begun withdrawing liquidity that was injected into the market after COVID-19 to curb soaring inflation. The U.S. Federal Reserve (Fed) announced on the 26th of last month (local time), after its Federal Open Market Committee (FOMC) regular meeting, that it is appropriate to raise interest rates soon.

If interest rate hikes by advanced countries become full-scale, pressure to raise the benchmark interest rate by the Bank of Korea is also likely to increase. Given that Korea has a high proportion of marginal firms unable to cover even interest expenses with operating profits, the impact will be unavoidable if the Bank of Korea raises rates.

According to a survey by the Korea Economic Research Institute under the FKI, the proportion of marginal firms in Korea is 18%, ranking fourth highest among 25 OECD countries, following Canada, the United States, and Greece.

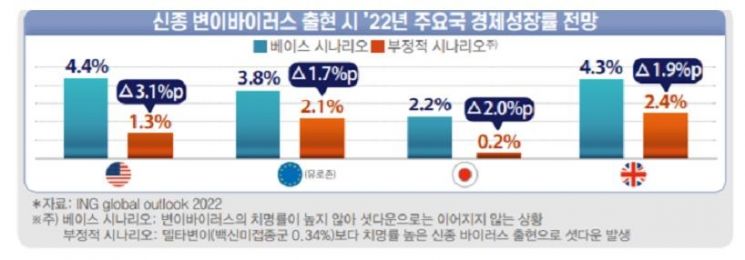

Moreover, the emergence of a new variant virus with a high fatality rate could further increase the likelihood of economic slowdown in Korea.

According to ING's global outlook, if a new virus emerges, the U.S. economic growth rate could drop by up to 3.1 percentage points, and growth rates in advanced economies are expected to slow by 2 to 3%. Consequently, domestic exports are also bound to be adversely affected.

The FKI forecasted that with multiple risks present in this year's economic situation, the addition of U.S.-China conflicts and a soft landing of the Chinese economy could further worsen the situation.

The International Monetary Fund (IMF) projects the U.S. economic growth rate this year at 5.2%, exceeding the global growth forecast of 4.9%.

Since the COVID-19 crisis, the U.S. has led global economic recovery and supply chains, and the FKI argues that South Korea, which has high dependence on China, must devise ways to minimize damage to Korean companies amid U.S.-China tensions.

The slowdown in the Chinese economy, South Korea's largest trading partner, due to disruptions in industrial production, is also a negative factor.

According to the IMF, the economic growth rates of the Group of Seven (G7) countries this year are expected to surpass pre-COVID-19 levels, but China is projected to record 5.6%, below the pre-pandemic 6.0%.

A Bank of Korea survey indicates that a 1 percentage point drop in China's growth rate would reduce South Korea's economic growth rate by 0.1 to 0.15 percentage points.

An FKI official stated, "South Korea's high dependence on exports to China and imports of intermediate goods makes a decline in growth rate inevitable due to China's economic slowdown," adding, "We must prepare for the anticipated crisis situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.