China focuses mining on Neodymium (Nd)... Kyunghee rare earths increased by 23%

Consolidation to Chinese rare earth giant... Strengthening dominance to weaponize rare resources

[Asia Economy Beijing=Special Correspondent Jo Young-shin] The Chinese government has decided to increase rare earth mining by 23% this year. However, it will not increase the mining of heavy rare earths.

According to Chinese media such as the Shanghai Securities News on the 31st, the Ministry of Industry and Information Technology and the Ministry of Natural Resources announced through a public notice that the primary rare earth mining volume this year will be 100,800 tons. They also limited the rare earth smelting volume to 97,200 tons this year.

Chinese media cited experts saying that light rare earth mining will increase by 23.2% this year, while heavy rare earth mining can be maintained at last year's level.

Rare earths, known as the rice of the 4th industrial revolution, are divided into heavy rare earths and light rare earths depending on their properties. Terbium (Tb) and Dysprosium (Dy) are representative heavy rare earths and have smaller reserves compared to light rare earths. Neodymium (Nd), Praseodymium (Pr), and Lanthanum (La), known as major raw materials for electric vehicle motor permanent magnets and batteries, are light rare earths.

Huanqiu Shibao explained regarding the Chinese government's primary rare earth mining notice that with the increase in new energy demand, the supply of Nd-Fe-B (hereafter Neodymium magnets) is necessary, and most of the increase in mining this year is due to Neodymium magnets. Neodymium magnets are representative magnetic alloys among rare earth element compounds, composed of Neodymium (Nd), Iron (Fe), and Boron (B). It is reported that Neodymium accounts for about 30% of the Neodymium magnets.

Wu Tianhui, a Chinese rare earth expert, said, "Neodymium magnets are mainly used in wind power generation, new energy vehicles (electric vehicles), and frequency conversion electronic devices," adding, "Considering the demand related to new energy, Neodymium mining is being increased."

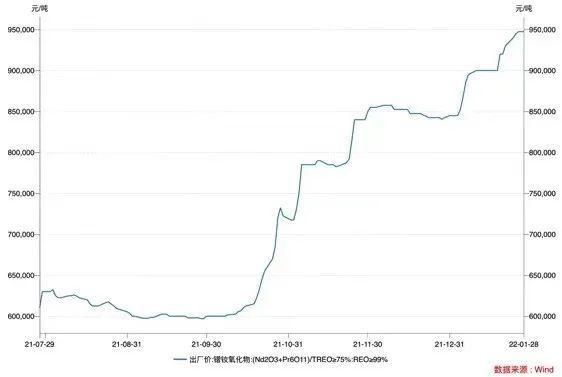

Yang Yuanhua, a Chinese rare earth analyst, said, "Although the increase in light rare earth mining and smelting is expected to somewhat ease the market supply and demand situation, there is still a supply-demand gap in the rare earth market this year," forecasting that there is still room for rare earth price increases.

What is notable in this Chinese government notice on rare earth mining and smelting is the intention to weaponize rare earth resources. At the end of last year, the Chinese government merged three rare earth companies mainly producing heavy rare earths in the southern region (Oguang Rare Earth, China Aluminum, and Southern Rare Earth Group) to create China Rare Earth Group. Unlike light rare earths, about 90% of the world's heavy rare earth reserves are known to be buried in southern China. This effectively granted China Rare Earth Group a global monopoly on heavy rare earths. In fact, the Chinese government allocated 67.94% of this year's heavy rare earth mining volume to China Rare Earth Group.

The Northern Rare Earth Group, a rare earth consortium mainly producing light rare earths in the northern region, was also empowered. This year, Northern Rare Earth's rare earth mining volume increased by 36.5% compared to the previous year. This accounts for more than 67% of China's total increase. The mining scale for other rare earth companies such as Guangdong Rare Earth Group remained stagnant. Additional mergers among Chinese rare earth companies cannot be ruled out.

Chang Guowu, Deputy Director of the Chinese Ministry of Industry and Information Technology, said, "It is necessary to create an environment for the development of the rare earth industry," adding, "We will encourage the absorption and reorganization of rare earth companies according to market principles and laws." He added that this would lead to the advancement of China's rare earth industry.

Despite the increase in rare earth mining in China, there are forecasts that rare earth supply will be insufficient this year. China Anxin Securities predicted that the supply-demand gap for rare earths still exists this year and that large-scale release of rare earths is difficult due to environmental issues.

Meanwhile, the Chinese Ministry of Commerce and the National Development and Reform Commission (NDRC) banned foreign investment in the rare earth and other mineral industries starting January 1 this year. They also completely blocked foreign access to data and samples related to rare earths, as well as access to production processes. The National People's Congress (NPC) previously enacted the Export Control Law, which allows restricting or banning the export of military and other goods to protect national interests and security. Rare earths are included in the substances covered by the Export Control Law.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)