Smith Attempts from January to March, 2.6 Times the Monthly Average Cases

[Asia Economy Reporter Lim Hye-seon] Spam, smishing, and voice phishing scam damages increase during the Lunar New Year holiday.

According to related industries on the 29th, the number of text messages containing suspicious internet addresses (URLs) related to smishing blocked by telecom companies last year was concentrated in the first to third months, accounting for more than 64% of the annual cases. This means that smishing attempts occurring from January to March were more than 2.6 times the monthly average in 2021.

SKT analyzed, “Considering that the 2021 Lunar New Year holiday was on February 12, smishing scam attempts were concentrated around the beginning of the new year and the Lunar New Year holiday,” adding, “It is presumed that this exploits the seasonal characteristics when New Year greetings and holiday deliveries increase.”

In fact, according to a recent government announcement, among about 200,000 smishing reports and blocks in 2021, cases exploiting periods such as the early new year and Lunar New Year holidays, when many deliveries are exchanged, accounted for about 175,000 cases, or 87% of the total.

In particular, due to the prolonged COVID-19 pandemic, various smishing scam texts are expected to increase. Cases have occurred where users are deceived by inducing confirmation of eligibility for national support funds and loss compensation or by baiting with special loan products for COVID-19 damage recovery.

Along with this, scam cases have also been increasing where messages pretending to be New Year greetings from acquaintances or urging recipients to check holiday gifts delivered by courier are sent at the start of the new year.

SKT emphasized that recently, spam, smishing, and voice phishing criminal groups are becoming more organized, and cases of impersonating not only family and financial institutions but also investigative agencies are increasing. There have also been reports of personal information leakage or phone interception for scams due to mistakenly installing malicious apps, so caution is required.

Below are recent major crime cases and how to respond to them.

Text messages impersonating financial companies to guide loans

If you receive loan guidance or application encouragement texts via SMS, it is advisable not to contact the phone number included in the message or the provided reply number. Even if you have spoken on the phone, if the other party asks you to click on an internet address sent via social networking services (SNS) like KakaoTalk or SMS or to install an application (app) and then apply for a loan, you should never comply to prevent damage. Especially, installing an app may infect your phone with malicious software.

Requesting cash transfers via text messages impersonating family or acquaintances

If you receive a message saying a family member or acquaintance has had an accident or their phone is broken and they are contacting you from a friend’s or nearby acquaintance’s phone, claiming “I am in an emergency,” you should directly contact the said family member or acquaintance to verify the message before responding. Responding to requests for ID cards, bank account information, or money transfers in a hurry may lead to damage.

Impersonating investigative agencies such as the prosecution to claim involvement in a crime

The prosecution, police, and Financial Supervisory Service officially state that they never request money transfers or collect personal financial transaction information under any circumstances. If you receive a call claiming to be from an investigative agency demanding personal money transfers or financial transaction information, verify the facts using official phone numbers of the institution before responding.

How to respond if you are worried about damage

If you suspect financial damage or other issues, it is advisable to immediately contact the customer center of the relevant financial institution, the police (112), or the Financial Supervisory Service (1332) to request suspension of payments on the account.

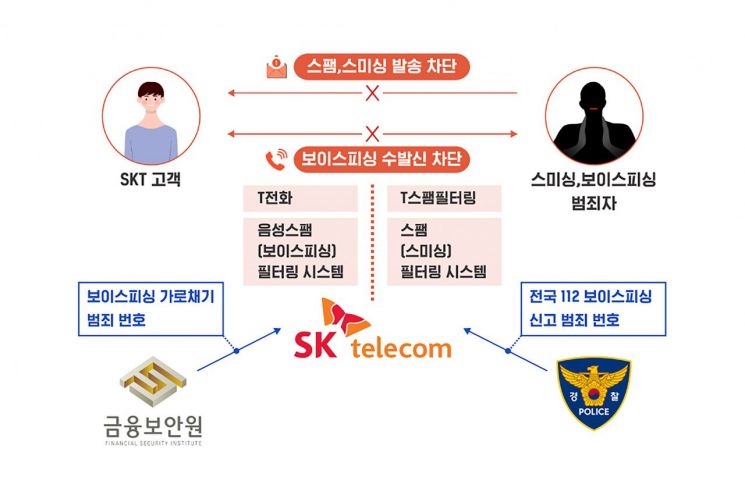

The Korea Internet & Security Agency (KISA) also accepts reports of spam and smishing, and SKT operates its own reporting and response channels to immediately respond to customers’ scam damages caused by spam. By forwarding suspicious spam messages to #8239, SKT analyzes the messages and can take measures such as blocking them in the system.

Using the call app T Phone provided by SKT also helps prevent damage in advance. T Phone shows users the type of spam for incoming and outgoing calls and phone number searches, and displays information such as “OO Bank Customer Center.” It is advisable to be cautious when making or receiving calls from numbers that cannot be verified or have no information in T Phone.

Additionally, it is important to carefully read and familiarize yourself with warning messages about spam, smishing, and voice phishing sent by telecom companies, financial institutions, and government agencies. Installing antivirus software on smartphones that can detect smishing messages can also be a method to prevent damage.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)