[Asia Economy Reporter Ji Yeon-jin] LG Energy Solution, which was listed on the Korea Exchange on the 27th of last month, will be included early in the Morgan Stanley Capital International (MSCI) index after the market closes on the 14th of next month. Although the stock price plunged more than 25% in the two days following the listing, attention is focused on whether the supply and demand burden will ease as passive funds flow in after the index inclusion.

According to the financial investment industry on the 1st, LG Energy Solution rose about 68.3% compared to the public offering price on the day of listing, and its closing market capitalization reached approximately 118 trillion won, ranking second in the domestic stock market by market capitalization, right after Samsung Electronics.

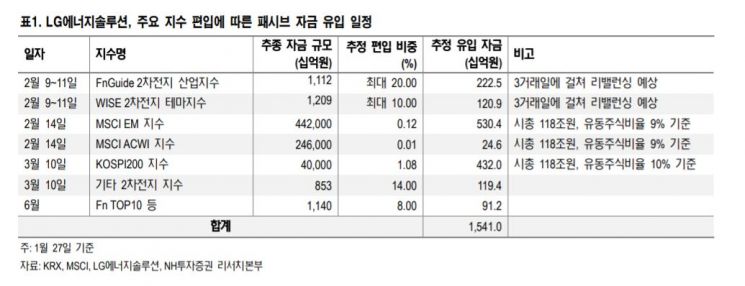

The free float ratio of LG Energy Solution, as calculated by MSCI, is 9%. Based on this free float ratio and a market capitalization of 118 trillion won, LG Energy Solution's weight in the MSCI Emerging Markets (EM) index is about 0.12%, with an inflow of funds estimated at up to 555 billion won.

Stock replacements are also scheduled for the KODEX Secondary Battery Industry Exchange-Traded Fund (ETF) and the TIGER Secondary Battery Theme ETF. Both are large ETFs with tracking assets exceeding 1 trillion won each. The indices these ETFs track will be rebalanced over three trading days from the 9th to the 11th of next month, and according to NH Investment & Securities, this rebalancing is expected to result in an additional inflow of 343.4 billion won into LG Energy Solution.

However, MSCI index inclusion is unrelated to whether foreign investors can short sell. Currently, short selling has partially resumed in the Korean stock market for KOSPI 200 and KOSDAQ 150 stocks. Short selling will be possible starting March 11, when LG Energy Solution is expected to be included early in the KOSPI 200.

Heo Yul, a researcher at NH Investment & Securities, said, "LG Energy Solution's early inclusion in the Financial Times Stock Exchange (FTSE) index failed because it did not meet the investable market capitalization criteria," adding, "It is expected to be included during the March quarterly review when shares released from lock-up will be treated as free float."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)