[Asia Economy Reporter Ji Yeon-jin] The 'January effect' did not occur. The KOSPI, which had been sluggish at the end of last year, turned the investors who expected a rally at the beginning of the year into a nightmare. The KOSPI index fell 10% from the beginning of the year and briefly broke below 2600 ahead of the Lunar New Year holiday. It broke through the lower bound of the KOSPI forecasted by the market earlier this year. Ahead of the long Lunar New Year holiday closure, it closed at the 2660 level due to simultaneous buying by individuals and institutions. Amid uncertain market outlooks for February, sectors benefiting from the recent soaring international oil prices are being suggested as investment strategies.

According to the financial investment industry on the 29th, next month's stock market will also face variables such as inflationary pressures, the fatality rate of the Omicron variant, and geopolitical conflicts. All of these factors are shrouded in uncertainty, making premature betting difficult.

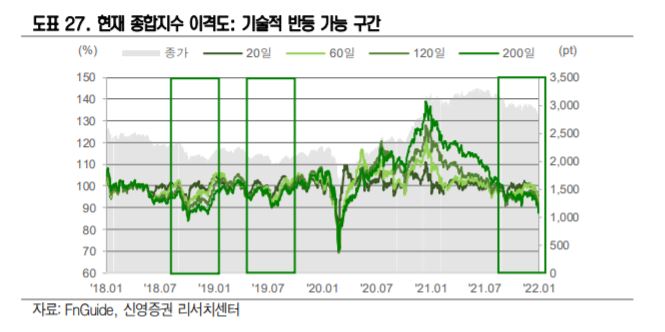

Researcher Hwang Ji-woo of Shin Young Securities said, "the Korean stock market has already priced in a significant portion of the negative factors since the second half of last year, and there is some room for improvement in variables, making it a challenging time to forecast style factors," adding, "the upward revision factor of earnings forecasts, which has consistently outperformed the benchmark since the second half of last year, is judged to be the most meaningful." He advised focusing on stocks that have shown steady improvement in earnings forecasts since the second half of last year.

The energy sector, which is performing best in terms of earnings forecasts and price returns, is expected to continue benefiting from international oil prices. In the IT sector, although there was an upward trend at the end of last year due to improved semiconductor industry outlooks, it experienced the largest decline due to stronger-than-expected tightening concerns. However, regardless of earnings per share (EPS) forecasts, defensive sectors (such as consumer staples, materials, and utilities) showed relative strength compared to the global average (YTD -5.6%) amid uncertain macroeconomic outlooks and concerns over the Federal Reserve's hawkish monetary policy.

Meanwhile, the domestic stock market is expected to rebound around the time when the listing of LG Energy Solution, which absorbed stock market funds with an unprecedented subscription frenzy, concludes.

Researcher Hwang said, "One of the reasons for the particularly severe drop in the Korean stock market in January includes the supply-demand imbalance caused by LG Energy Solution's record-breaking IPO," adding, "Funds tracking the KOSPI had to adjust the weights of other stocks according to the proportion LG Energy Solution will hold in the KOSPI going forward due to the subscription success, and the period after LG Energy Solution's listing is judged to be a time when a KOSPI rebound can be expected." He especially suggested approaching stocks that had excessive declines unrelated to fundamentals from a mid- to short-term trading perspective.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)