Q4 2021 Operating Profit Consensus Trending Downward 'February Earnings Shock Inevitable'

Clear Panic Selling Leads to Increased Stock Volatility in February 'Hold Rather Than Panic Sell'

[Asia Economy Reporter Lee Seon-ae] The domestic stock market, which faced panic selling in the last week of January, is now bracing for an ‘earnings shock’ crisis in February. Due to increased volatility in supply and demand, the market has become like ‘chupungnakyeop’ (falling leaves in the wind), and although the Q4 earnings shock was already anticipated, it could further amplify stock price volatility, requiring investor caution.

◆ Panic Selling with the Worst January Returns = Panic selling is clearly evident in the domestic stock market in January. According to the Korea Exchange on the 28th, the KOSPI closed at 2,614.49, down 94.75 points (3.50%) from the previous trading day (2,709.24). This is the lowest closing price in about 14 months since November 30, 2020, when it was 2,591.34. The KOSDAQ also closed at 849.23, down 32.86 points (3.73%) from the previous trading day (882.09), marking its lowest close since November 17, 2020, when it was 839.47.

January’s returns are expected to be the worst since the global financial crisis in 2008. Kim Kwang-hyun, a researcher at Yuanta Securities, said, “This January’s returns are the lowest since 2008,” adding, “Out of 200 universe stocks, 152 stocks declined in January this year.” Heo Jae-hwan, head of the investment strategy team at Eugene Investment & Securities, pointed out, “It is the worst since March 2020 during the COVID-19 pandemic (KOSPI -11.7%) and October 2018 amid the US-China trade conflict (-13.4%).”

The market downturn was driven by a massive sell-off by foreign investors. Foreigners sold more than 2 trillion won in a single day, pushing the Korean stock market back to levels seen two years ago. Jerome Powell, Chairman of the US Federal Reserve, made hawkish remarks immediately after the Federal Open Market Committee (FOMC) meeting, which heightened market fears. Ki Yoom-ji, a researcher at Kiwoom Securities, interpreted, “It is difficult to accept that the KOSPI dropped from the 2,900 level to the 2,600 level in a short period, but this week’s sharp decline can only be seen as panic selling.”

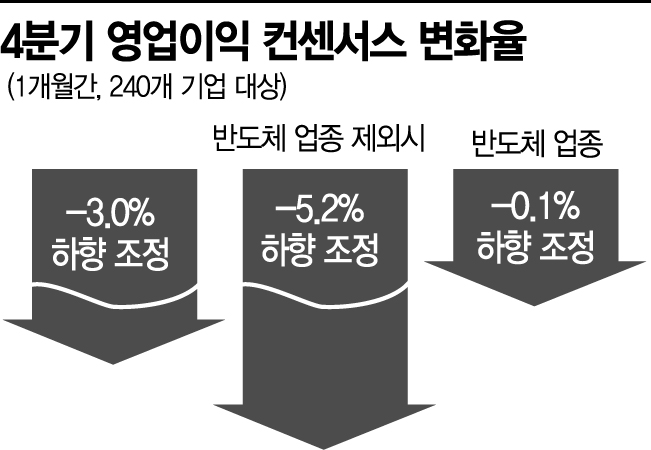

◆ Accelerated Downgrade of Q4 Operating Profit Estimates = An earnings shock is also forecasted for February. According to financial information provider FnGuide, among 240 companies with continuous quarterly consensus, the Q4 2021 operating profit consensus was downgraded by 3.0% over the past month. Excluding the semiconductor sector, the downgrade in operating profit consensus reached 5.2%. Out of 26 industries, only four did not see a downward revision in operating profit consensus. Particularly, the utility, shipbuilding, hotel and leisure services, automobile, software, chemical, machinery, and media sectors experienced significant downward revisions in profit forecasts. For 165 KOSPI-listed companies, the Q4 operating profit consensus was also revised down by 6.3% compared to the estimate of 51.8127 trillion won a month ago.

Researcher Yoo Myung-gan of Mirae Asset Securities warned, “Currently, corporate profit momentum is slowing down. Since this quarter typically includes one-time costs every year, an earnings shock may seem natural, but in times of high uncertainty like now, it can increase stock price volatility.”

Lee Kyung-min, head of the investment strategy team at Daishin Securities, also noted, “Q4 results have consistently fallen short of expectations every year. The Q4 operating profit outlook is being revised downward compared to the previous month, and with 15 out of 26 industries showing declining results, earnings uncertainty could become another variable affecting KOSPI fluctuations in February.”

◆ Operating Profit Outlook for This Year is Upward... “Excessive Overselling” = Although stock price volatility is inevitable, securities firms generally expect the KOSPI 2600 level to act as a support line. One researcher said, “The 2600 level is a technical support line (based on weekly 120) and is below the 5-year average (2646) and 10-year average (2679) of the 12-month forward price-to-book ratio (PBR). Considering this, the current situation has entered a buying zone rather than panic selling or holding.”

Lee said, “The low 2600 range of the KOSPI is an index level where excessive decline and valuation attractiveness can be highlighted,” forecasting, “If investor sentiment and supply-demand instability calm down, a technical rebound attempt will be possible.” Heo also emphasized, “The KOSPI 2600 range reflects a 10% decrease in operating profit for this year. Since the PBR has fallen to 1.03 times, further declines will subside, and there is no choice but to hold on.”

The operating profit consensus for listed companies this year is on an upward trend. The Q1 operating profit estimate for 97 KOSPI-listed companies is 45.9981 trillion won, revised upward from 45.2971 trillion won a month ago. Operating profit for 224 companies this year is expected to increase by 9.3%.

Kim Su-yeon, a researcher at Hanwha Investment & Securities, explained, “Currently, there are no signs of downward profit trends among KOSPI companies, and price-wise, the KOSPI is in an oversold territory.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.