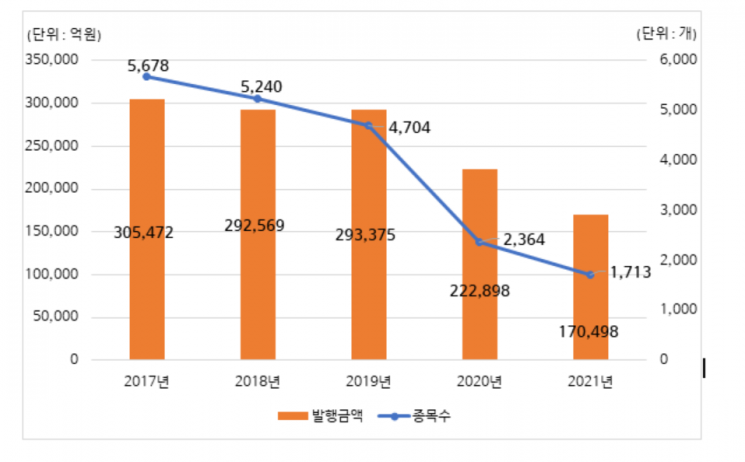

[Asia Economy Reporter Minji Lee] The Korea Securities Depository announced on the 27th that the issuance amount of DLS (including DLB) last year was 17.0498 trillion KRW, a 23.5% decrease compared to the previous year.

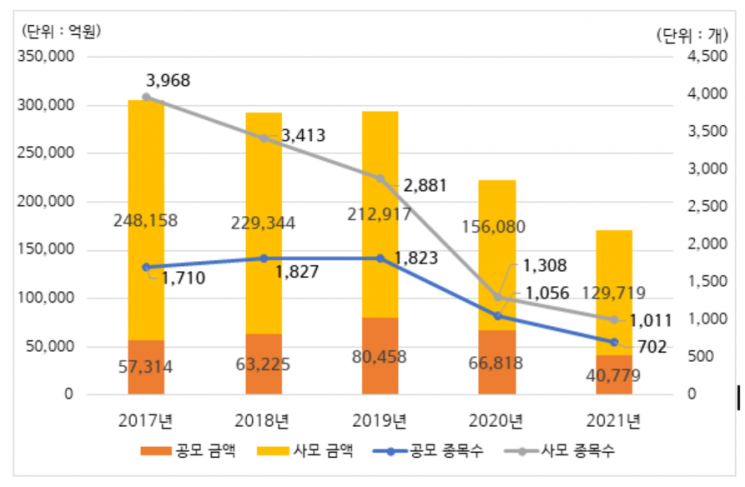

By issuance type, the public offering issuance amount accounted for 24% of the total (4.0779 trillion KRW), while private placement issuance amounted to 76.1%, recording 12.9719 trillion KRW. The public offering amount decreased by 39% year-on-year, and the private placement amount decreased by 16.9% during the same period.

By underlying asset, DLS with interest rates as the underlying asset accounted for the largest share with 10.5 trillion KRW (61.5%). This was followed by credit (5.2 trillion KRW, 30.7%) and mixed type (1.1 trillion KRW, 6.6%) in order of issuance scale.

Looking at the issuance scale by securities companies last year, Samsung Securities had the largest amount with 2.4706 trillion KRW. The combined issuance amount of the top five companies was 9.3007 trillion KRW, accounting for 54.6% of the total DLS issuance.

The DLS redemption amount last year recorded 17.2 trillion KRW, an increase of 46.8% compared to the previous year. Redeemed DLS consisted mostly (97%) of maturity redemptions and early redemptions, with 9.1 trillion KRW and 7.6 trillion KRW respectively, while early redemptions accounted for 5 billion KRW, or 2.9%. As of the end of last year, the outstanding balance of unredeemed DLS issuance increased by 2.2% year-on-year to 27.5 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)