"Possibility of DRAM Market Reversal in First Half... Gradual Stabilization of Advanced Process Yield"

"QD Display Products Expected to Launch in First Quarter"

"Increasing Uncertainty Calls for Conservative Cash Flow Management"

Samsung Electronics achieved a record high performance with annual sales exceeding 279 trillion won. On the 7th, Samsung Electronics announced that its preliminary consolidated results for last year showed sales of 279.04 trillion won and an operating profit of 51.57 trillion won. The Samsung flag is fluttering in the wind in front of Samsung Electronics' Seocho building on this day. Photo by Mun Ho-nam munonam@

Samsung Electronics achieved a record high performance with annual sales exceeding 279 trillion won. On the 7th, Samsung Electronics announced that its preliminary consolidated results for last year showed sales of 279.04 trillion won and an operating profit of 51.57 trillion won. The Samsung flag is fluttering in the wind in front of Samsung Electronics' Seocho building on this day. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Lee Hye-young] Samsung Electronics announced that, given the continued uncertainty in the global business environment this year, it will establish investment plans by comprehensively reviewing supply chains and market conditions. Regarding this year's DRAM price outlook, the company analyzed that improvement signals were observed, such as a shortened decline cycle compared to expectations. The foundry (semiconductor contract manufacturing) business is experiencing delays in securing yields for cutting-edge processes but is expected to gradually stabilize.

Samsung Display plans to launch TVs and monitors equipped with QD (Quantum Dot) OLED displays within the first quarter and expects to achieve yield competitiveness by the end of the year.

Both companies presented these forecasts during a conference call held on the 27th after announcing their 2021 performance results.

Regarding semiconductor investment plans for this year, Samsung Electronics stated, "Due to various uncertainties, specific investment plans will be continuously discussed," adding, "As equipment delivery times are lengthening due to component supply chain issues, investment plans will be established and executed considering this factor."

Samsung Electronics did not provide an annual memory semiconductor growth forecast this year, considering the increasing macroeconomic uncertainties.

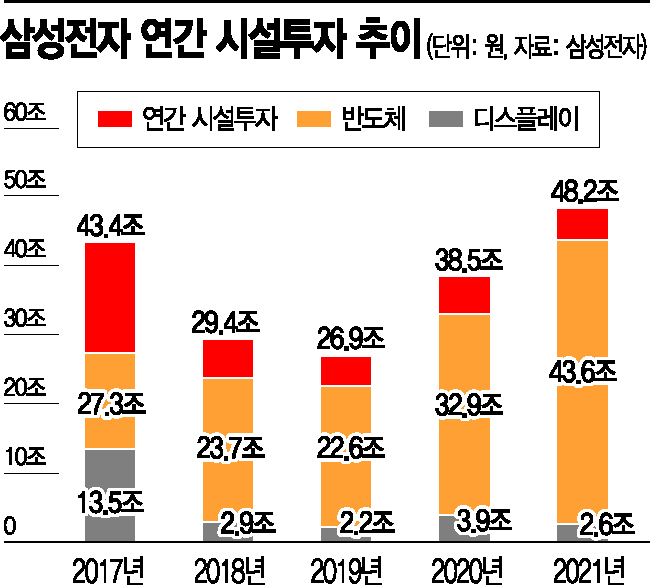

Last year, Samsung Electronics made a record facility investment of approximately KRW 48.2 trillion, an increase of about KRW 9.7 trillion from the previous year's KRW 38.5 trillion. By business sector, KRW 43.6 trillion was invested in semiconductors and KRW 2.6 trillion in displays, with about 90% of total investment concentrated in semiconductors.

Regarding this, Samsung Electronics explained, "Last year's memory investment amount increased compared to the previous year, and both DRAM and NAND had a high proportion of capital expenditure within total investment," adding, "To respond to demand growth exceeding early-year forecasts, advanced process expansion was carried out, and proactive investments in high-cost next-generation technologies such as extreme ultraviolet (EUV) lithography were made due to a technological inflection point."

Regarding the memory shipment volume falling short of previous forecasts in the fourth quarter of last year, Samsung Electronics analyzed, "Server-centered demand was solid in Q4, but global supply chain issues lasted longer than expected, and disruptions in set production affected memory demand to some extent." They further explained, "In this situation, inventory levels were not high, and considering potential production impacts due to the Xi'an lockdown, aggressive sales expansion was restrained," as the reason for the shipment decrease.

On this year's DRAM price outlook, the company stated, "It is clear that the volatility and cycle length of the memory market have been shrinking compared to the past, and inventory levels remain healthy, suggesting market stabilization. Some external institutions predict a market turnaround in the first half of the year, which we also consider a possible scenario."

Samsung Electronics' foundry business, which will see large-scale investments, is experiencing delays in securing yields for cutting-edge 4-nanometer (nm; one billionth of a meter) and 5-nanometer processes compared to expectations. Kang Moon-soo, Vice President of the Foundry Strategy Marketing Office, said, "Due to process miniaturization and increased complexity, it is true that the difficulty of securing stable initial yields has increased. Although the expansion of initial production capacity for advanced processes is delayed compared to plans, gradual stabilization is expected."

He added, "A supply shortage is expected across all foundry processes in the first quarter. The proportion of advanced processes, which significantly increased from the fourth quarter, will further rise, and we plan to focus on improving advanced process yields to steadily increase customer demand." He also mentioned, "The first-generation GAA (Gate All Around) process has been completed, and quality verification will be finished for mass production in the first half of the year. The second-generation 3-nanometer GAA process will also be developed according to the scheduled timeline."

Samsung Display commented on the QD OLED display, which began mass production last month, stating, "TVs and monitors equipped with QD displays will be officially launched in the market during the first quarter," and "By the end of the year, QD yield is expected to become competitive."

Regarding the possibility of changes to shareholder return policies, Samsung Electronics expressed a skeptical stance. Vice President Seo Byung-hoon said, "Global uncertainties have increased more than expected, and production disruptions have occurred, including last year's Austin foundry plant in the U.S. and recently the NAND flash plant in Xi'an, China," adding, "Considering these situations, conservative cash management is necessary, and it is not appropriate to change shareholder return policies at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)