Individual Investors Net Buy 1.3 Trillion KRW of Kakao This Year

Overlapping Adverse Factors Including Platform Regulation and KakaoPay Embezzlement Controversy

Kakao Stock Price Down 48% from Last Year's Peak

Low-Price Buying After 'Bottom Recognition' at the Beginning of the Year

[Asia Economy Reporter Ji Yeon-jin] The Donghak Ants, who have been the backbone of the domestic stock market since the beginning of the year, caught the falling knife. Despite various adverse factors such as last year's government platform regulations and the stock option profit-taking by KakaoPay executives, the nation's messenger Kakao is hitting new yearly lows again this year, but individual investors seem to be buying at low prices.

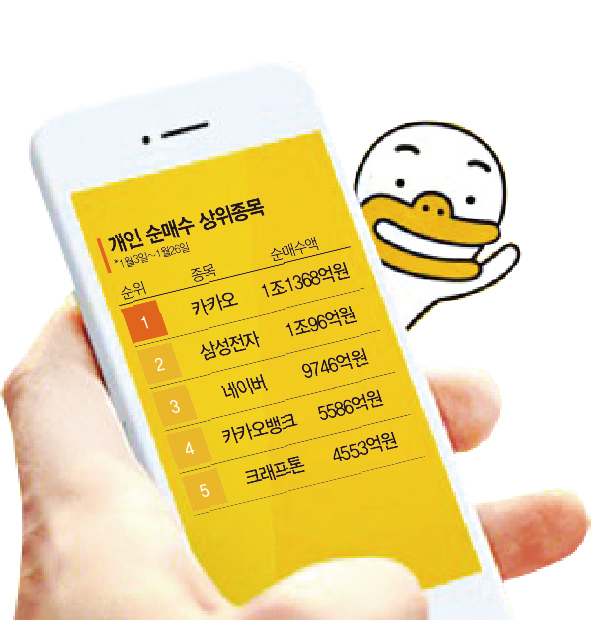

As of 10:33 a.m. on the 27th, Kakao recorded 84,000 won, down 3.22% from the previous day. This is a 52-week low. Kakao, which closed at 114,000 won on the first day of this year's opening, has been continuously weak since the next day. Amid this, Kakao is the stock with the largest net purchase by individual investors this year, who have bought about 1.1368 trillion won worth of shares since the beginning of the year.

Kakao soared to 173,000 won last June, driven by high growth expectations based on KakaoTalk, known as the "national messenger," but its stock price sharply declined as the government began comprehensive platform regulations due to controversies such as infringement on local businesses. At the end of last year, Kakao's stock price plunged again as executives, including Ryu Young-joon, CEO of KakaoPay, exercised stock options and pocketed hundreds of billions of won in profits. Kakao's stock price fell about 48% from last year's peak and has dropped more than 24% this year alone.

Because of this, individual investors seem to believe that Kakao's stock price has bottomed out and have started buying at low prices this year. In fact, the market expects a rebound this year, given the large drop in Kakao's stock price last year. SK Securities analyst Choi Kwan-soon said in a report on the 19th, "Kakao's stock price has fallen more than 45% from last year's peak, fully reflecting the adverse factors such as platform regulation issues," and predicted a rebound this year.

However, as the U.S. interest rate hikes and monetary tightening approach, foreign investors have begun to exit emerging market stocks in earnest, changing the situation. Foreigners have sold mainly growth stocks, which were the beneficiaries during the COVID-19 liquidity boom, further dragging down Kakao's stock price.

Since the beginning of the year, individual investors have made strenuous efforts to defend the stock market by net buying 6.9031 trillion won worth of shares in the KOSPI, but institutions and foreigners have net sold 5.7773 trillion won and 850.5 billion won respectively, causing the index to fall sharply. On this day, foreigners net sold more than 1 trillion won within about an hour after the market opened, continuing the six-day consecutive "Sell Korea" rally, and the KOSPI fell below the 2,650 level. The KOSDAQ index also retreated to 850 after falling below 900 for the first time in three days.

Most of the top stocks in individual net purchases are similar to Kakao. Since the beginning of the year, individuals have net bought Samsung Electronics (1.0096 trillion won), NAVER (974.6 billion won), KakaoBank (558.6 billion won), and Krafton (455.3 billion won) in that order after Kakao. Their year-to-date returns are Samsung Electronics -6.74%, NAVER -16.76%, KakaoBank -31.97%, and Krafton -36.75%. Lee Kyung-soo, a researcher at Hana Financial Investment, said, "Interest rate hikes are favorable for stocks that have been excessively sold off or undervalued, as well as high-dividend stocks, but have a negative impact on overvalued stocks. Especially, the current situation where financial authorities are pushing for a full resumption of short selling to challenge inclusion in the MSCI developed market index is putting more pressure on growth stock prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.