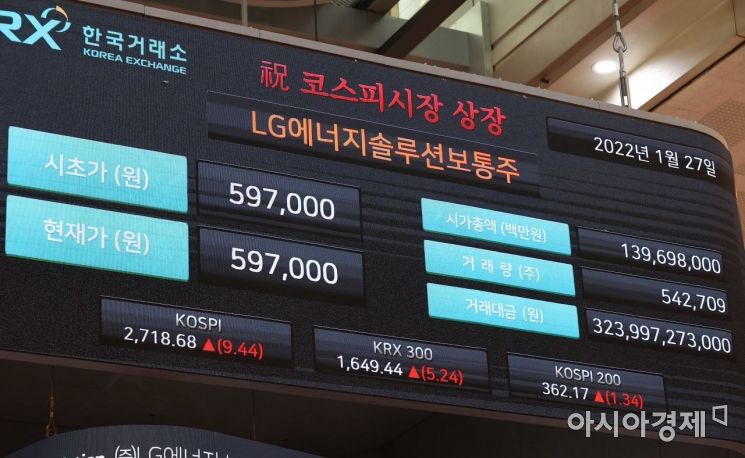

On the morning of the 27th, at the Korea Exchange in Yeouido, Seoul, the opening price of 597,000 won was displayed on the electronic board during the KOSPI listing ceremony of LG Energy Solution. LG Energy Solution's market capitalization is 112.32 trillion won, surpassing SK Hynix to claim the 2nd place in market capitalization rankings. Photo by Jinhyung Kang aymsdream@

On the morning of the 27th, at the Korea Exchange in Yeouido, Seoul, the opening price of 597,000 won was displayed on the electronic board during the KOSPI listing ceremony of LG Energy Solution. LG Energy Solution's market capitalization is 112.32 trillion won, surpassing SK Hynix to claim the 2nd place in market capitalization rankings. Photo by Jinhyung Kang aymsdream@

[Asia Economy Reporter Lee Seon-ae] On the 6th, the KOSPI index fell more than 2%, plunging below the 2650 level. The Federal Reserve (Fed) hinted at a rate hike in March through the January Federal Open Market Committee (FOMC), and the record-breaking LG Energy Solution IPO is increasing volatility.

As of 10:32 AM, the KOSPI is at 2645.23, down 2.36% from the previous trading day. The KOSPI index started the day rising around the 2709 level and even reached 2722 at one point, but then turned downward and dropped to the 2600 level. If it closes like this, it will record the lowest closing price since December 1, 2020, when it closed at 2634 points.

Foreigners' massive selling is fueling the index decline. At this time, foreigners have sold about 1.1906 trillion KRW in the KOSPI market alone. They are also net sellers of 250 billion KRW in the KOSDAQ market.

Individuals are net sellers of 482.9 billion KRW in the KOSPI market but net buyers of 239.9 billion KRW in the KOSDAQ market. Institutions are net buyers of about 1.7055 trillion KRW and 1.8 billion KRW in the two markets, respectively.

Most sectors are in decline. Pharmaceuticals, non-metallic minerals, chemicals, and steel & metals are down about 3%. Construction, textiles & apparel, food & beverages, distribution, services, paper & wood, finance, insurance, manufacturing, and electricity & gas are down about 2%. Machinery, banking, electronics, securities, and telecommunications are down about 1%. Medical precision is up less than 1%.

Top market capitalization stocks are also mostly down. LG Energy Solution rose to the second largest market cap with its listing. LG Energy Solution, which started at 597,000 KRW, less than twice its IPO price (300,000 KRW), is down nearly 20%. Samsung Electronics and SK Hynix are down 1-2%.

Weak sectors in KOSDAQ include digital content (-3.49%), pharmaceuticals (-2.49%), and telecommunications equipment (-2.29%).

Han Ji-young, a researcher at Kiwoom Securities, explained, "The domestic stock market is under bearish pressure influenced by negative factors from the U.S. Furthermore, with the listing of LG Energy Solution, volatility in supply and demand has increased for the stock itself, secondary battery-related stocks, and top market cap stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)