[Asia Economy Reporter Lee Seon-ae] LG Energy Solution's stock market debut on the 27th was not as spectacular as the various IPO records it set. Although it immediately became the second-largest company by market capitalization on the KOSPI, it failed to achieve the 'ttasang'?opening price set at twice the IPO price followed by a limit-up on the first day. Despite high expectations for a ttasang due to the limited float on the listing day, the stock experienced extreme volatility, plunging more than 20% influenced by foreign selling pressure.

◆ Foreigners sold 580 billion won within 30 minutes = LG Energy Solution started trading at an opening price of 597,000 won. The opening price is set within a range of 90% to 200% of the IPO price based on pre-market bids. Although it began near 600,000 won, the momentum did not continue.

This was due to a flood of sell orders mainly from foreign investors. Within 10 minutes of the market opening, LG Energy Solution's trading volume reached 2 trillion won. Considering that the total KOSPI trading volume at the same time was about 2.62 trillion won, this means that about 80% of the KOSPI trading volume was concentrated in a single stock. The cause was massive foreign selling. Foreign investors sold 580 billion won worth of LG Energy Solution shares within about 30 minutes of the market opening. Consequently, LG Energy Solution's price plunged more than 20% from the opening price, falling to 450,000 won. The volatility in LG Energy Solution's supply and demand also directly affected the index. The KOSPI fell below the 2,700 level within 20 minutes of opening. As of 10:50 a.m., foreign net selling in the KOSPI market exceeded 1.25 trillion won.

This is interpreted as a sharp deterioration in investor sentiment following the announcement of the results of the January Federal Open Market Committee (FOMC) meeting. The U.S. Federal Reserve reiterated its hawkish stance, making a March rate hike and early quantitative tightening almost certain.

However, LG Energy Solution proved its status as a market leader by immediately becoming the second-largest company by market capitalization on the KOSPI. Its market cap exceeded 120 trillion won at the start of trading, surpassing SK Hynix (around 86.6 trillion won).

◆ Large-cap selling vs. KOSPI downside support = Opinions are divided on the impact of the changes in supply and demand brought by LG Energy Solution on the domestic stock market. As it rises to the second-largest position on the KOSPI, the market capitalization weights of other large-cap stocks will decline, potentially triggering selling pressure on existing stocks.

Lee Kyung-min, a researcher at Daishin Securities, said, "Assuming LG Energy Solution's market capitalization is 100 trillion won, Samsung Electronics' market cap weight will decrease by 1.06 percentage points, and SK Hynix's weight will decrease by 0.21 percentage points. If LG Energy Solution continues to rise, competition to secure shares will intensify, leading to large-scale selling in other large-cap stocks."

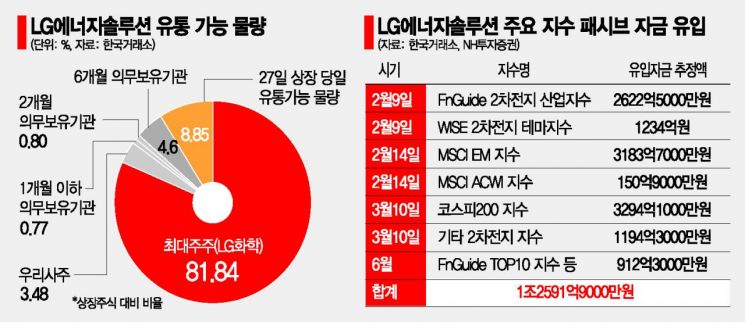

There is also growing interest in the direction of passive funds worth over 1 trillion won related to LG Energy Solution. Index inclusion schedules are lined up starting next month. It is estimated that 1.2592 trillion won will flow into LG Energy Solution through index funds. The asset management industry expects a price upcycle for LG Energy Solution during this period. However, selling pressure on large-cap stocks is expected to be unavoidable. As a large-cap stock is newly included in the index, funds will inevitably flow out of top market cap stocks like Samsung Electronics.

Heo Yul, a researcher at NH Investment & Securities, explained, "If LG Energy Solution's market capitalization exceeds 100 trillion won, investors benchmarking the KOSPI will need to free up 4.7% of their existing portfolios to include LG Energy Solution. The larger the weighting of a stock in the index, the greater the adjustment required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)