Stock Market Freezes Sharply and Loan Interest Rates Rise

Trillions in Investment Funds Have Nowhere to Go

Retail Investors Say "Let's Save on Interest"

7 Trillion Won Returns Straight to Banks

Markedly Different from Last Year's Kakao Bank Subscription

[Asia Economy Reporter Sim Nayoung] The credit loan amount, which temporarily ballooned during the LG Energy Solution (hereafter LG EnSol) subscription period, has returned intact to the banks. Individual investors who had taken out large amounts of credit loans, including overdraft accounts, repaid their debts immediately after failing to receive allotments of public offering shares following the subscription deadline, by reclaiming the subscription deposits they had placed as a form of down payment.

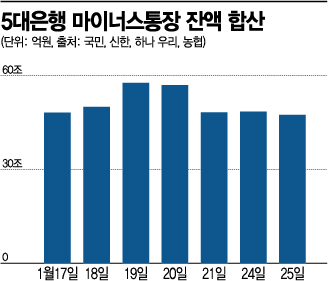

According to the five major banks on the 27th, the outstanding balance of overdraft loans was recorded at 48.8012 trillion won as of the 25th. This is a decrease of 7.5566 trillion won compared to the peak overdraft loan balance of 56.3578 trillion won on the 19th, during the LG EnSol subscription period. The outstanding balance of credit loans also retreated by 7.8536 trillion won during the same period (from 146.2705 trillion won to 138.4169 trillion won).

This phenomenon is a ‘money move’ in line with the LG EnSol subscription schedule. Recently, as the stock market has sharply frozen and loan interest rates have risen, investment funds worth trillions of won have found no place to go and have returned to the banks. A representative from a commercial bank said, "If the stock market had not collapsed, the LG EnSol subscription refund would have continued to circulate in the market by being invested in other domestic and foreign stocks, but this time investors repaid their loans immediately to reduce even a penny of loan interest," adding, "This is a completely different situation from when the stock market was hot last year."

During the KakaoBank subscription in July last year, the loan amount did not easily decrease even after the refund of the deposit. The overdraft loan balance (based on the five major banks) rose to 52.3224 trillion won on the subscription day and only decreased by 3.528 trillion won to 48.7944 trillion won after the refund day. A senior official from the Financial Services Commission explained, "Household loans increased by 10 trillion won in January last year alone, but this year it is expected to fall far short of that," adding, "The current loan market is relatively stable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.