"10.2 Trillion Investment Funds Allocated to Building Global Supply Chains"

On the 10th, Kwon Young-soo, Vice Chairman and CEO of LG Energy Solution (center), and others attended the LG Energy Solution IPO online press conference. (Photo by LG Energy Solution)

On the 10th, Kwon Young-soo, Vice Chairman and CEO of LG Energy Solution (center), and others attended the LG Energy Solution IPO online press conference. (Photo by LG Energy Solution)

[Asia Economy Reporter Moon Chaeseok]

"We will consider this listing not as the conclusion of the past 30 years but as the starting point for a new 100 years."

On the 27th, Kwon Young-soo, Vice Chairman and CEO of LG Energy Solution, expressed his thoughts on LG Energy Solution's new listing on the Korea Exchange (KOSPI) with these words. On the morning of the same day, a 'New Listing Commemoration Ceremony' was held at the Korea Exchange in Yeouido, Seoul, attended by key executives including CFO Executive Director Lee Chang-sil and Korea Exchange Chairman Sohn Byung-doo.

Right after trading began, Kwon Young-soo wrote on the large electronic display board at the Korea Exchange, "We will become a company trusted and loved by customers." He said, "Since taking the first step as a pioneer in South Korea's secondary battery business in 1992, after a considerable 30 years, we have finally achieved the fruit of listing."

LG Energy Solution Writes a New Chapter in KOSPI Listing History

LG Energy Solution set various records during its initial public offering (IPO) process. This is the first time a single stock's public offering amount on KOSPI has surpassed 10 trillion KRW. In the demand forecast targeting domestic and international institutional investors, it recorded a competition rate of 2023:1, rewriting the KOSPI IPO record. In the public subscription for general investors, it gathered approximately 114.1066 trillion KRW in subscription deposits, setting another record. The number of subscription applications (4,424,470) also broke the record for the highest since the ban on duplicate subscriptions.

Kwon added, "I would like to express my gratitude to all customers, shareholders and investors, partners, and our proud employees, and ask for your continued interest and support."

LG Energy Solution's opening price on the day was set at 597,000 KRW, 99% higher than the public offering price of 300,000 KRW. Although the opening price was nearly double the public offering price, achieving a so-called 'double' (dda), it failed to reach 'ddasang' (dda-sang), which means the opening price is set at twice the public offering price and then hits the upper limit price. Early in the trading session, a flood of sell orders caused extreme volatility with rapid rises and falls.

Secured 10.2 Trillion KRW After Listing... "Building a Global Supply Chain"

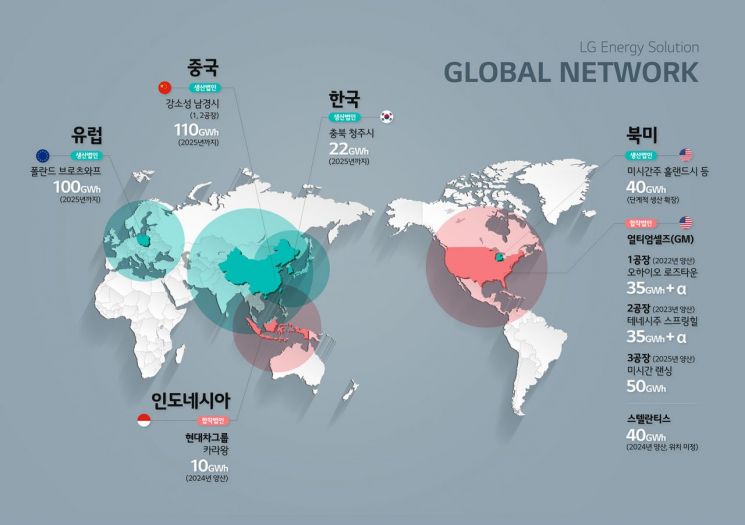

Explanation material on LG Energy Solution's five-point production system, which is strengthening production capacity in the North American market. Production lines have been established in 'Korea, North America, China, Poland, and Indonesia.' (Source: LG Energy Solution)

Explanation material on LG Energy Solution's five-point production system, which is strengthening production capacity in the North American market. Production lines have been established in 'Korea, North America, China, Poland, and Indonesia.' (Source: LG Energy Solution)

After the listing, LG Energy Solution secured about 10.2 trillion KRW in investment funds. The company stated that these funds will be used to expand production capacity at global manufacturing bases, invest in next-generation battery research and development (R&D), and new business ventures. LG Energy Solution said, "We will expand investments in global production bases in Korea, Europe, and China," adding, "We will proactively respond to the demands of major customers and establish a supply chain through local mass production to further solidify our leading position in the global secondary battery market."

According to the securities registration statement, LG Energy Solution plans to invest 5.6 trillion KRW by 2024 to expand production capacity in North America, and invest 1.4 trillion KRW and 1.2 trillion KRW respectively in production plants in Europe and China. For the Ochang plant in Korea, the company plans to invest 645 billion KRW by next year and establish a cylindrical battery production line for electric vehicles (EVs), which have recently seen increased demand. The day before, LG Energy Solution announced plans to build a third joint electric vehicle battery plant worth 2.6 billion USD (approximately 3.1101 trillion KRW) in Lansing, Michigan, together with General Motors (GM), the top car manufacturer in the United States. Including the third plant, joint ventures with North American customers, and LG Energy Solution's sole investments, the production capacity in North America is expected to reach 200 GWh.

The company plans to invest 1.6043 trillion KRW in R&D costs for lithium-ion batteries and next-generation batteries, as well as investments to improve product quality and process enhancements. It also announced plans to pursue new businesses such as battery recycling and the BaaS (Battery as a Service) platform business.

LG Energy Solution is the first company in Korea to start secondary battery research in 1992. The company stated that it has built competitiveness over 30 years in various aspects such as technology, products, customer management, and production. It emphasized its strong competitiveness in the intellectual property (IP) field as well. A company official said, "Over the past 10 years, we have invested 5.3 trillion KRW in R&D and hold a total of approximately 22,900 patents (as of September 2021) in materials, processes, and core technologies," adding, "We have a global R&D workforce of about 3,300 people."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)