[Asia Economy Reporter Park Ji-hwan] Shinhan Financial Investment stated on the 27th that Dentis is expected to show a full-fledged performance growth this year due to an increase in domestic market share and expansion into China and the United States.

Dentis, established in March 2005, is a specialized company in the development and production of implants and dental equipment. Its main products include implants, dental equipment (chair units, LEDs, dental 3D printers), and dental bone graft materials. As a latecomer in the implant industry, it aims to increase domestic market share through price competitiveness and expand overseas markets.

Researcher Jung Min-gu of Shinhan Financial Investment evaluated, "In addition to the existing implant and dental lighting business, the expansion into new businesses such as digital clear aligner solutions is underway, and mid- to long-term growth is expected."

Dentis is expected to expand its market share through faster customer responsiveness and price competitiveness compared to competitors in the domestic clear aligner market. In particular, from this year, the clear aligner new business is expected to be fully launched through education and the establishment of mass production facilities. Researcher Jung said, "Since the first half of 2021, clear aligner solution training has been conducted, and the number of dentists who completed the training has rapidly increased to 300 within seven months," adding, "The goal is to recruit 1,000 member dentists by the end of this year."

With the expansion of the clear aligner production line, an annual production capacity of 7,200 cases (approximately 36 billion KRW in sales) is expected to be secured. Clear aligner sales are expected to increase by 50.1% year-on-year to 4.2 billion KRW in 2022. It is anticipated to rise to 9.8 billion KRW in 2023 when the mass production line for clear aligners is fully operational. As the supply of clear aligner solutions increases, sales of high-margin products such as resin and clear aligner devices are also expected to increase simultaneously. Researcher Jung believes that profitability improvement is also expected due to the increasing proportion of related sales in the future.

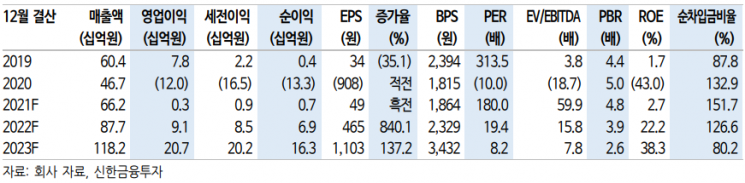

This year, Dentis's performance is expected to reach sales of 87.7 billion KRW, a 32.5% increase from the previous year. Operating profit is expected to increase by 2,581.0% to 9.1 billion KRW during the same period. Researcher Jung forecasted, "This year's performance growth will be driven by an increase in domestic market share, full-scale expansion of sales in China and the United States, and contributions from clear aligner new business sales."

However, in the fourth quarter of last year, an operating loss of 2.2 billion KRW is expected, marking a return to deficit. The main causes are delays in new customer deliveries due to COVID-19 and increased upfront investment costs by the clear aligner subsidiary TNS. Researcher Jung said, "Since the end of November, implant exports overseas have normalized, and TNS is also expected to turn profitable from the first half of 2022," adding, "Performance improvement is expected from the fourth quarter of last year as the bottom."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.