[Asia Economy Reporter Song Hwajeong] From now on, internet-only banks will also be subject to the same loan-to-deposit ratio (LDR) regulations as general banks for household loans. This measure was taken by financial supervisory authorities to curb household loans by internet-only banks and to promote loans to small and medium-sized enterprises (SMEs) or individual business owners.

On the 27th, the Financial Services Commission and the Financial Supervisory Service announced a draft amendment to the supervisory regulations, which includes revisions to the LDR system for internet-only banks and exceptions to face-to-face transaction rules.

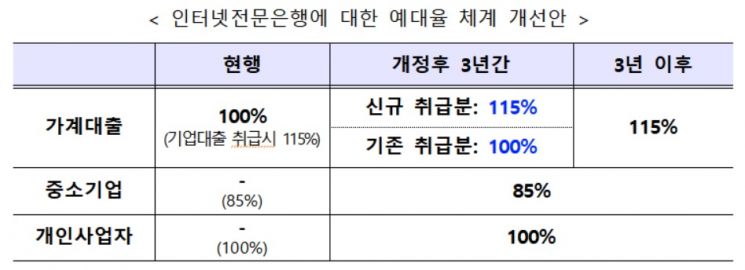

Through the amendment of the supervisory regulations, the weighted LDR for household loans by internet-only banks will increase from 100% to 115%, the level applied to general banks. The LDR is calculated by dividing the loan balance by the deposit balance and is currently required to be maintained within 100%. By raising the household loan weighting from 100% to 115%, a total loan balance of 10 billion KRW will be calculated as 11.5 billion KRW in the LDR. To comply with the LDR limit (100%), banks will need to curb household loans accordingly. However, a three-year grace period will be provided, during which the 115% weighting will apply only to new household loans.

Until now, internet-only banks, considering their early stage of operation, applied a 100% weighting to household loans if they did not handle corporate loans. The 115% weighting was applied to all previously handled household loans only when they started to handle new corporate loans to expand funding to productive sectors.

A Financial Supervisory Service official explained, "The purpose of this legislative notice is to activate loans to SMEs or individual business owners by internet-only banks, but it will effectively curb household loans."

So far, financial authorities have implemented borrower-based total debt service ratio (DSR) regulations to tighten household loans. From this month, with the strengthening of DSR ratio regulations, if an individual's loan amount exceeds 200 million KRW, the annual principal and interest sum cannot exceed 40% of their annual income (50% in the non-bank sector).

Additionally, to promote corporate loans by internet-only banks, exceptions to face-to-face transaction requirements will be revised. The current Internet-only Bank Act stipulates that internet-only banks conduct business through electronic financial transactions rather than face-to-face transactions. However, face-to-face transactions are exceptionally allowed only when electronic financial transactions are legally or technically difficult or when necessary for consumer protection and convenience.

The amendment revises the exceptions for face-to-face transactions by considering the characteristics of SME loans that require on-site inspections. Face-to-face transactions will be allowed when on-site inspections are necessary to verify actual business operations or the authenticity of non-face-to-face submitted documents (such as articles of incorporation and board meeting minutes). Also, face-to-face transactions will be permitted when entering into joint guarantee contracts with SME representatives.

Furthermore, through improvements to the enforcement decree, various reporting procedures for banks will be improved, and the scope of delegated duties to the Financial Supervisory Service Governor will be revised.

First, when there is a change in the stockholding status of the same person in a bank, the reporting deadline to the Financial Services Commission will be extended from "within 5 business days" to "within 10 business days." Also, when a bank's overseas local subsidiary is sanctioned by the local supervisory authority, it must be reported to the Financial Supervisory Service, but cases involving less than 2,000 USD will be excluded. A Financial Services Commission official explained, "Considering that it may be difficult to report on time due to unforeseen circumstances when there are many affiliates or foreign shareholders," and added, "Requiring reports on all sanctions regardless of severity is somewhat excessive compared to the regulatory purpose, and considering that the minimum fine under the Bank Act is 2 million KRW."

To enhance the efficiency of bank management and supervision, the scope of delegated duties to the Financial Supervisory Service Governor will be revised to include the review of approvals for transfer and acquisition of bank operations, receipt of reports on non-operating assets held by banks, and requests for submission of necessary materials to verify whether a bank shareholder is exercising actual influence.

The amendments to the Bank Act enforcement decree and supervisory regulations are expected to be implemented within the first half of this year after legislative notice and review by the Ministry of Government Legislation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)