Discussion on Measures to Block Dollar Payments Excluding SWIFT

Qatar and Australia Consider Production Expansion to Prepare for European Natural Gas Shortage

[Asia Economy reporters Park Byung-hee and Lee Hyun-woo] Major foreign media outlets reported on the 25th (local time), citing U.S. government officials, that the United States and the European Union (EU) have nearly reached an agreement on financial sanctions against Russia.

The U.S. and the EU are exchanging broad opinions under the judgment that while preparing military response postures in case of a possible Russian invasion of Ukraine, inflicting economic damage could be an effective means to deter Russia's invasion of Ukraine.

A U.S. official said that the U.S. and the EU are aligning their views on financial sanctions targeting Russian banks in the event of a Russian invasion of Ukraine. In this regard, Bloomberg reported that a plan to exclude major Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), thereby blocking dollar payments, is being discussed.

A U.S. government official said, "The focus is on reaching an agreement on the scale of financial institutions and Russian state-owned enterprises to be sanctioned," adding, "The impact of the sanctions on financial markets such as stocks is also being discussed."

It is known that the U.S. and the EU are also discussing export control measures in the technology and energy sectors in addition to financial sanctions. At the same time, the U.S. official said that they are reviewing ways to resolve Europe's energy supply shortage if Russian energy exports are controlled. The official also stated that discussions are underway with Qatar, Australia, and others to increase gas production in preparation for a potential shortage of gas supply to Europe.

Bloomberg reported that Germany is demanding exceptions in Russian regulations related to the energy sector. Limiting Russia's natural gas exports could cause a severe energy shortage in Europe. Other European countries besides Germany are also discussing exceptions regarding the energy supply shortage, and accordingly, the energy sector may be exempted in Russian regulations, Bloomberg said. An EU official said that more coordination work is still needed behind the scenes regarding sanctions on Russia.

U.S. military pressure on Russia continues as well.

U.S. President Joe Biden said at a press conference on the same day, "Some of the troops on standby to be deployed to Eastern Europe could be moved soon." This emphasized that the 8,500 U.S. troops on standby, as announced by the U.S. Department of Defense the day before for possible activation of NATO's Response Force (NRF), could be deployed to Eastern Europe. President Biden stressed, "We are not trying to provoke but to reassure European countries concerned about the current situation, and we have no intention of stationing U.S. or NATO troops in Ukraine."

When asked whether personal sanctions against President Vladimir Putin would be considered if Russia invades Ukraine, President Biden replied, "We are considering it," warning, "If Putin moves, he will face serious economic consequences."

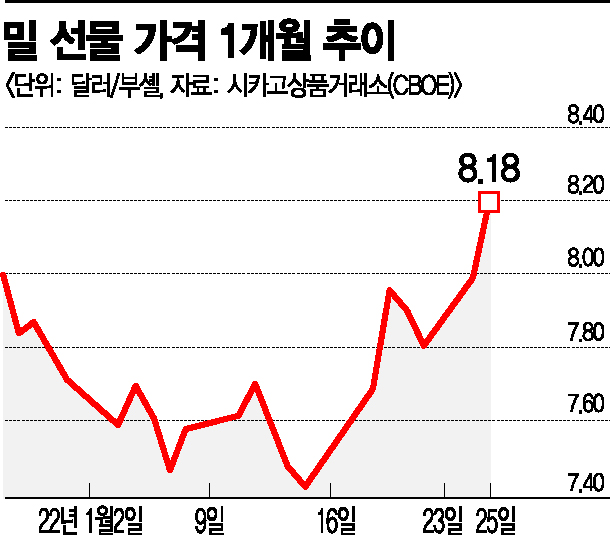

As tensions in Ukraine escalate, global major stock markets have plunged, causing turmoil in financial markets, and the impact is spreading to the grain market. Bloomberg reported that wheat futures prices surged on the day to reach the highest level in two months.

On the Chicago Board of Trade (CBOE), wheat futures closed at $8.18 per bushel, up 2.2% from the previous trading day. During the session, prices surged 3.9% to $8.32 per bushel, the highest since November last year.

Jack Scoville, vice president of Price Futures Group, a futures brokerage firm based in Chicago, explained, "Wheat prices are rising due to concerns that war could break out in Ukraine, potentially halting wheat exports from Russia and Ukraine."

Russia and Ukraine are the world's first and fifth largest wheat exporters, respectively, and their export volumes account for about one-third of global exports.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)