[Asia Economy Reporter Lee Seon-ae] From the New Year, investors who have made "Yeongkkeul" (pulling together all their soul) investments have been engulfed in the fear of forced liquidation due to margin calls. Approximately 20 billion KRW worth is being liquidated daily. They are facing the worst debt-financed investment scenario.

According to the Korea Financial Investment Association on the 26th, the scale of forced liquidations arising from unsettled trades averaged 20.4 billion KRW per day from the beginning of this month to the 20th, a sharp increase of 37.83% compared to the previous month. On the 11th, forced liquidations amounted to 31.4 billion KRW in a single day, the largest scale in the past three months. The monthly daily average forced liquidation scale decreased from 19.1 billion KRW in October last year to 17 billion KRW in November and 14.8 billion KRW in December, but surged to 20.4 billion KRW this month.

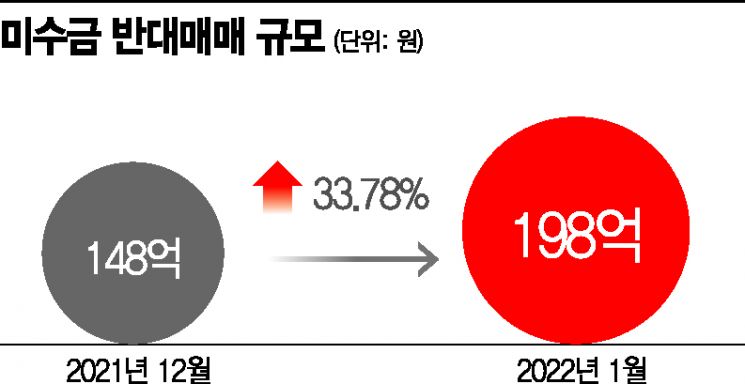

As of the 25th, the daily average scale of forced liquidations in January was 19.8 billion KRW, an increase of 33.78% compared to the previous month. Although it may appear to have decreased, experts believe the actual scale is larger and inevitably increasing. The Korea Capital Market Institute predicted, "Considering individual investors' stock-backed loans, the actual scale of forced liquidations will increase even more."

The volume of forced liquidations is expected to further weigh down the stock market, so investors' complaints are unlikely to cease. Considering that the returns of individual investors' net purchased stocks last year and this month are all recorded as negative, it is estimated that they are sitting on a huge cushion of losses. Stocks such as KakaoBank, Kakao, and Krafton have significantly influenced the negative returns.

Seohak Gaemi (Korean investors investing in US stocks) are also deeply worried as their losses increase. Due to the sharp declines in the Nasdaq, Dow, and Standard & Poor's indices, Tesla and Apple stock prices have fallen by double digits. Especially, since many have purchased leveraged products that can yield 2 to 3 times the profit when successful, the losses are inevitably large.

The cryptocurrency market is in a state of panic. Bitcoin has halved, and coins related to NFTs (Non-Fungible Tokens) have dropped beyond half to about one-third of their value. If investors flee in fear, the downward trend can only worsen.

Meanwhile, the domestic stock market started with a rebound after the recent sharp decline but could not sustain the upward trend. The KOSPI, which rose 0.87% at the opening, fell 0.43% at 10:15 a.m., breaking below the 2710 level. As of 11 a.m., the index recorded a 0.28% increase at 2728.13.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)