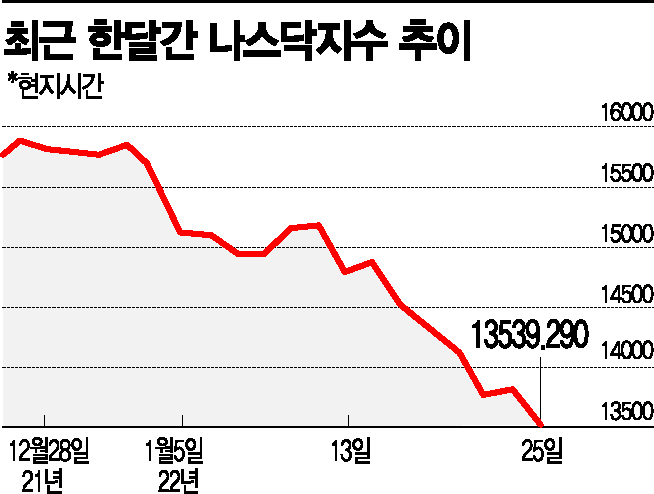

[Asia Economy New York=Special Correspondent Joselgina] ‘13.46%’. This is the decline rate recorded by the Nasdaq Index of the U.S. New York stock market since the beginning of the year. On the 25th (local time), when the Federal Open Market Committee (FOMC) began, the New York stock market once again closed down across the board after a rollercoaster session. The market’s tightening anxiety watching the FOMC once again overwhelmed investor sentiment. On Wall Street, there is a mood that the so-called ‘Fed Put,’ where the Federal Reserve (Fed) defends against market collapse, is no longer expected.

On that day, the Nasdaq Index, centered on technology stocks, closed at 13,539.29, down 315.83 points (2.28%) from the previous trading day. Unlike the previous day’s drama where it fell nearly 5% intraday and then made a dramatic rebound, there was no such event. The Dow Jones Industrial Average fell 66.77 points (0.19%) to 34,297.73, and the S&P 500 Index dropped 53.68 points (1.22%) to 4,356.45.

The Nasdaq Index has plunged 13.46% since the beginning of the year, already entering a technical correction phase, and the large-cap-focused S&P 500 Index (-8.60%) is also on the verge of a correction.

Adam Crisafulli, founder of research firm Vital Knowledge, described the atmosphere as a “rollercoaster,” adding, “The intraday low from the previous day was not broken.” The New York stock market, which fell to the 3% range in the morning, began to reduce its losses in the afternoon with bargain buying. However, about 10 minutes before the market closed, the decline in major indices widened again.

By stock, representative technology stocks such as Tesla (-1.25%), Nvidia (-4.48%), Microsoft (MS, -2.66%), and Netflix (-5.35%) all retreated together. These companies have all recorded double-digit declines compared to the beginning of the year. Tesla has fallen 13.09%, Nvidia 24.1%, and Netflix a staggering 39.18% since the start of the year.

Now, the market’s attention is focused on the two-day FOMC meeting starting that day. The key interest is how clearly Fed Chair Jerome Powell will signal a rate hike in March during the press conference on the afternoon of the 26th. If guidance on balance sheet reduction is provided, early tightening signals will become even clearer.

If Chair Powell’s hawkish remarks are weaker than the market expects, there is a possibility that investors will aggressively engage in bargain buying, leading to a rebound in the indices. Ryan Jacob, Chief Investment Officer of Jacob Asset Management, said, “Market uncertainty will continue until the FOMC,” but added, “After several weeks of aggressive sell-offs, investors now seem to be stepping in for bargain buying.” The dramatic rise at the close the previous day and the intraday rebound confirmed that day are representative examples.

However, most experts drew a line on expectations for the Fed Put, where the Fed acts as a safety net during sharp stock price declines. Given the inflation situation, which has reached the highest level in 40 years, it is expected that the Fed’s priorities will not change.

Bloomberg News warned that day, “Considering the ultra-loose fiscal situation, soaring prices, and overvalued valuations, the likelihood of Fed intervention is very low,” and “Do not expect the Fed to quickly step in to rescue the stock market this time.” Mike Wilson, Chief Strategist at Morgan Stanley, appeared on CNBC the previous day and pointed out, “The inflation data is not weak enough for the Fed to back off from tightening.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)