Tesla and Apple Stocks Fall by Double Digits

Nasdaq 100 Triple-Leveraged ETF Attracts 490 Billion Won

6 of Top 15 Net Bought Stocks Are Leveraged Products

"Risky to Expect Quick Profits, Avoid Additional Purchases"

[Asia Economy Reporter Minji Lee] Investor A (30) finds the rapidly changing stock market environment since the new year confusing. At the end of last year, frustrated with the domestic stock market (Gukjang), he switched to the US stock market (Mijang), but this year his losses have only increased. Contrary to expectations that the decline would be a short-term correction, every morning he wakes up to stocks that have fallen further, leaving him with nothing but sighs.

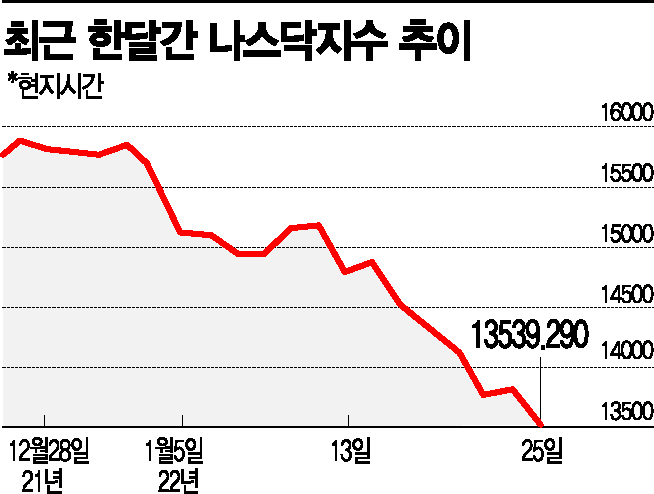

The mood among Seohak Ants (Korean investors investing overseas) who turned to the US stock market, which is experiencing increased volatility heading toward the bottom, is growing more somber. They believed they could recover losses made in the domestic market through Mijang, but now the decline is even greater than in the domestic market (KOSPI -8.9%). The Nasdaq index has dropped more than 14.5% since the beginning of the year, returning to levels seen a year ago, while the Dow Jones Industrial Average and the S&P 500, composed of 30 blue-chip stocks, have fallen more than 6.3% and 9.2%, respectively. Even Tesla (-23%) and Apple (-12%) stock prices have fallen by double digits. With no signs of a rebound, it seems difficult to engage in 'mul-tagi' (averaging down by buying additional shares at lower prices) at this point.

According to the Korea Securities Depository's securities information system, SEIBRO, as of the 26th, the most purchased overseas stock by investors was the 'PROSHARES ULTRAPRO QQQ ETF.' This leveraged product tracks three times the return of the Nasdaq 100 index, and domestic investors bought 489.7 billion KRW worth during this period. Leveraged products can yield two to three times the profit when the market rises but can also cause losses exceeding two to three times when the market falls. As the Nasdaq index, sensitive to interest rates, plummeted due to the Federal Reserve's accelerated tightening, investors judged this as a buying opportunity and began accumulating shares in large quantities.

The 'big bet' by Seohak Ants continued with other stocks. About half of the top 1 to 15 net purchases were leveraged products aimed at high returns. They accumulated SOXL (DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF), which tracks three times the Philadelphia Semiconductor Index, worth 301.9 billion KRW; BMO MICROSECTORS FANG INNOVATION 3X LEVERAGED ETN, a 3x leveraged product investing in 'FANG' innovative companies, worth 90.8 billion KRW; DIREXION DAILY TECHNOLOGY BULL 3X SHS ETF, a 3x leveraged product composed of tech stocks, worth 74.9 billion KRW; PROSHARES ULTRA QQQ ETF, which seeks twice the return of the Nasdaq 100 index, worth 67.6 billion KRW; and DIREXION DAILY SP BIOTECH BULL 3X SHS ETF, a 3x leveraged product composed of biotech companies, worth 58.8 billion KRW.

Domestic investors have traditionally bought leveraged ETFs whenever the Nasdaq index experienced short-term corrections. The returns were not bad. In September last year, when the spread of the Delta variant increased, the Nasdaq index fell more than 7% until October but then rose more than 10% within about a month. However, the current situation is different. Instead of enjoying decent profits from leveraged investments, it is uncertain whether the principal can be recovered even if the index rises again. For example, assuming an investment of 10 million KRW, if the Nasdaq index falls by 20%, a regular 1x ETF would decrease to 8 million KRW. If the index then rises by 30%, it can recover to 10.4 million KRW. However, a 3x leveraged ETF would drop to 4 million KRW, and even if it rises by 90%, the amount received would only be 7.6 million KRW. A senior official from an asset management company explained, "Trying to make money quickly in the short term now is a risky idea," adding, "The Federal Reserve will likely deliver a bigger shock than market sentiment to control inflation."

Securities experts advise caution even when averaging down on overseas stocks. Until this month, the top net purchased stocks by domestic investors were Nvidia (305.7 billion KRW), Apple (234.7 billion KRW), and Microsoft (233.5 billion KRW). Tesla (209.8 billion KRW) also ranked sixth. All are tech stocks listed on Nasdaq, and the demand for averaging down to lower the average purchase price is interpreted as the reason for the inflow. KB Securities researcher Sanghoon Kim said, "Supply and demand data that can indicate market direction are generally negative," advising, "As margin collateral is decreasing and foreigners are net selling US stocks, the support to the downside is weak, so buying should be restrained until concerns reach their peak."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)