January KB Leading Apartment 50 Index

Increase Rate 0.4%, Second Consecutive Month in the 0% Range

Housing Price Adjustment Phase Expands to Gangnam

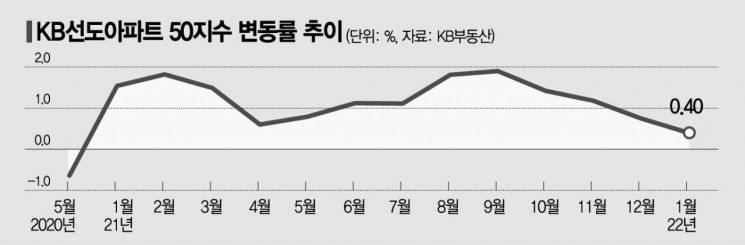

[Asia Economy Reporter Kim Min-young] The prices of the top 50 apartments by market capitalization nationwide recorded a 0% range increase rate for the second consecutive month. Attention is focused on whether the housing price stabilization trend, which began in the outskirts of Seoul and Gyeonggi Province, will expand to key areas in Seoul such as Gangnam.

According to KB Real Estate on the 25th, this month's 'KB Leading Apartment 50 Index' stood at 147.8, rising only 0.40% compared to the previous month. This index had maintained a 1% range monthly increase since June last year but recorded a 0% range in December last year, and the increase narrowed further this month. In terms of the increase rate alone, this is the lowest level since May 2020 (-0.64%).

The KB Leading Index selects the top 50 apartment complexes nationwide by market capitalization each year and shows the rate of change in market capitalization. Because it reflects price changes most sensitively, it is mainly used as a leading indicator to foresee the overall market one step ahead. Most of these complexes, such as Banpo Xi in Banpo-dong, Eunma Apartment in Daechi-dong, Jamsil Jugong Complex 5 in Jamsil-dong, and Dogok Rexle in Dogok-dong, are located in the Gangnam area, where high-priced homes exceeding the loan ban threshold of 1.5 billion KRW are concentrated, and thus were hardly affected by loan regulations such as the Debt Service Ratio (DSR).

The fact that housing prices in these complexes have entered an adjustment phase can be interpreted as the price decline trend in the outskirts of Seoul and Gyeonggi Province spreading to the city center, including Gangnam. As the housing market adopts a wait-and-see stance in response to variables such as interest rate hikes and the presidential election, demand for the so-called 'smart one home' is also shrinking.

A KB Real Estate official said, "The leading index literally reflects the market in advance, indicating that the rapid slowdown in high-priced apartment prices has been confirmed by the index," adding, "This also proves that the transaction contraction in Gangnam complexes, as well as in the outskirts of Seoul, is leading to price stagnation."

This trend is also confirmed by other statistics. Looking at the weekly apartment trends from the Korea Real Estate Board, the sales price index growth rate in the southeastern region, which includes the four Gangnam districts of Seocho-gu, Gangnam-gu, Songpa-gu, and Gangdong-gu, decreased for three consecutive weeks from 0.04% in the first week of January (3rd) to 0.03% and then 0.02%. The actual price index in the southeastern region also turned negative, recording a -0.05% change as of November last year.

Price drops have also been observed in some Gangnam complexes. A 76.79㎡ unit in Eunma Apartment, Gangnam-gu, Seoul, was traded for 2.635 billion KRW (11th floor) in November last year but changed hands for 2.49 billion KRW this month, dropping by 145 million KRW. A 84.99㎡ unit in Resentz, Songpa-gu, was traded for 2.55 billion KRW (5th floor) and 2.57 billion KRW (11th floor) in December last year, but the same size unit was traded for 2.5 billion KRW (5th floor) this month, falling by 50 to 70 million KRW within a month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.