Unregistered Used Car Dealer Operations

Financial Partner Store Legal Violations Reported

Controversy Persists Despite Simple Explanation

[Asia Economy Reporter Ki Ha-young] Woori Financial Capital has been accused of conducting auto installment finance product sales through unregistered used car dealers in violation of the Financial Consumer Protection Act. While Woori Financial Capital claims it is merely a simple introduction, concerns have been raised that this constitutes a violation of the Act and infringes on consumer rights.

According to the industry on the 25th, 25 representatives of nationwide financial partner stores filed a complaint against Woori Financial Capital at the Dunsan Police Station in Daejeon for violating the Financial Consumer Protection Act. The main point is that they are paying commissions to unregistered and unqualified used car dealers and conducting illegal financial product sales. Under the Financial Consumer Protection Act, which has been in effect since March last year, financial companies must go through partner stores registered as financial product intermediaries with the Financial Services Commission to sell installment products to consumers. Those who operate product sales without registering as financial product sales businesses face imprisonment of up to five years or fines of up to 200 million won.

Typically, when purchasing a used car, customers decide on the vehicle through consultation with a used car dealer, and if a loan is needed, they request loan consultation from the dealer and financial partner store. The financial partner store applies for loan screening to the financial company offering the best conditions based on the customer's credit information and loan terms, and the loan is finalized once the financial company approves it.

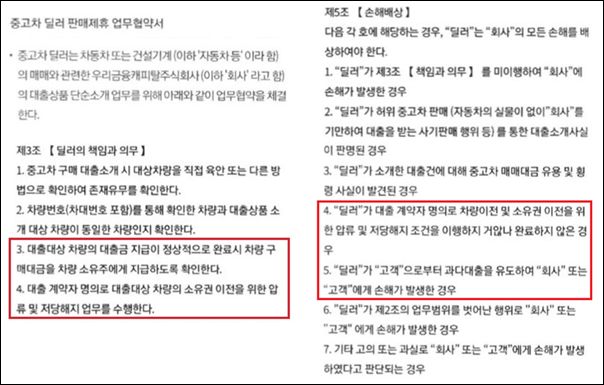

Woori Financial Capital maintains that it is not brokering products but merely making simple introductions, so it is not violating the Financial Consumer Protection Act. However, the "Used Car Dealer Sales Partnership Agreement" that Woori Financial Capital signs with used car dealers specifies that the dealer is responsible for the usual ‘seizure and mortgage cancellation tasks (for ownership transfer of the loaned vehicle)’ typically performed by financial partner stores after receiving loan-related documents from customers. It also holds dealers accountable if they induce excessive loans to customers causing losses to the company or customers.

This behavior raises significant concerns about potential harm to used car buyers. Officially registered intermediaries can be fined up to 50% of their income for violating six major sales regulations under the Financial Consumer Protection Act, including unfair sales practices, improper solicitation, and false or exaggerated advertising. However, unqualified used car dealers evade these legal nets, increasing the risk of incomplete sales and inevitably neglecting consumer protection. Furthermore, if a used car dealer brokers a specific financial company favorable to themselves rather than the customer, the consumer’s choice is limited, and cost burdens are likely to increase.

The financial partner store industry is also reportedly suffering significant damage from such loan brokerage activities. The number of partner stores nationwide, which was about 250 at the end of 2019, decreased to around 100 within a year, and the remaining companies’ sales dropped by approximately 30% during the same period.

An industry insider in auto finance said, "There are concerns that this controversy will further deepen consumer distrust in the used car market, which is already viewed unfavorably in terms of consumer protection," adding, "Strong corrective measures by financial supervisory authorities are necessary to prevent the spread of such illegal operations to other financial companies."

In response, Woori Financial Capital stated, "Dealers only make simple introductions, and our consultation staff handle customer service," and claimed, "We have received an interpretation from financial authorities that simple introductions do not require registration as financial product intermediaries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)