Will the Nightmare of Ramen Price Fixing Repeat? Business Community Concerns

Limitations in Expertise and Neutrality of Trustee Responsibility Committee... "Fund Management Headquarters Should Decide"

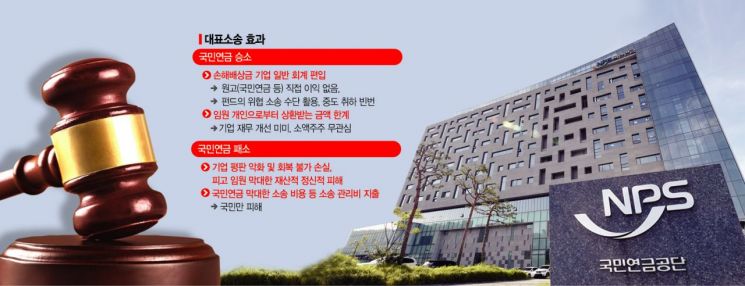

[Asia Economy Reporter Yu Je-hoon] The business community's call for legislative amendments to hold the National Pension Service (NPS) civilly liable for losses caused by excessive shareholder derivative lawsuits stems from a "painful" memory of hundreds of billions of won in tangible and intangible damages suffered due to repeated lawsuits against the government. To prevent such past incidents from recurring, the business sector argues that the NPS Fund Management Headquarters, which is responsible for overall fund management, should have the authority to decide on shareholder derivative lawsuits and establish a system to hold it accountable for any losses arising from such lawsuits.

The 'Ramen Cartel' Nightmare... Vulnerable Mid-sized and Small Companies on Edge

A representative nightmare recalled by the business community is the 2012 "ramen cartel" case announced by the Korea Fair Trade Commission (KFTC). At that time, the KFTC imposed fines totaling approximately 130 billion won on four companies?Nongshim, Samyang Foods, Ottogi, and Paldo?for colluding to unfairly raise wholesale prices over about ten years starting in 2001. The repercussions of this case extended overseas. The following year, U.S. wholesalers and retailers filed a class-action lawsuit against these four companies, claiming damages due to the price-fixing of ramen in Korea.

Nongshim, the industry leader, immediately filed an administrative lawsuit and, after a protracted legal battle, ultimately won. The KFTC not only refunded Nongshim's fine of 107.7 billion won but also paid an additional 9.4 billion won as interest on the refund. Despite the excessive sanctions causing companies to expend tangible and intangible resources both domestically and abroad, and public funds being wasted, no one was held responsible.

A business official noted, "The companies involved lost significant opportunity costs due to this case, but no one took responsibility. If the Stewardship Responsibility Committee (SRC) excessively files derivative lawsuits, such situations could recur, and this could provoke fierce attacks from foreign investors holding minority stakes, raising serious concerns about the damage to companies."

The business community's greatest concern is that such past cases could spread across domestic companies. The total amount the NPS has invested in the domestic stock market reaches about 165 trillion won. Considering this scale, approximately 2,200 listed companies could all become targets of lawsuits. Particularly, 73% of the companies invested in by the NPS are mid-sized and small enterprises with weak litigation capabilities, raising fears that indiscriminate shareholder derivative lawsuits could cause greater turmoil.

Park Yang-gyun, head of policy at the Korea Federation of Mid-sized Enterprises, said, "Most companies invested in by the NPS are mid-sized and small businesses with weak litigation capabilities, so the SRC's shareholder derivative lawsuits could impose a significant management burden," adding, "This would increase costs substantially, amplify stock market volatility, and stifle corporate management activities."

Stewardship Committee Swayed by External Forces, Concerns Over Excessive Lawsuits

The business community expresses considerable concern that granting the SRC authority over shareholder derivative lawsuits could lead to a surge in such lawsuits. This is due to a lack of expertise and the committee's inherent vulnerability to government influence. The SRC consists of nine members: three full-time experts who meet qualification requirements, and six others recommended by labor, employer, and regional subscriber organizations (two each).

Although the composition appears balanced on the surface, the Ministry of Health and Welfare participates as the secretary, and the seats recommended by civic groups vary depending on the administration, making the committee inherently susceptible to government influence. This means the committee is structurally prone to being swayed by external political forces.

This contrasts with overseas pension funds that have structures resilient to external pressures. For example, the board of directors of the Canada Pension Investment Board (CPPIB), one of the most renowned overseas pension funds, comprises 12 members: five each from financial institutions and general corporate CEOs, and one each from academia and the legal sector, effectively excluding government officials. Similarly, Japan's Government Pension Investment Fund (GPIF) management committee consists entirely of nine private investment and finance experts, except for one chairman.

Choi Jun-seon, emeritus professor at Sungkyunkwan University, stated, "The NPS's shareholder derivative lawsuits should not be conducted solely based on internal guidelines like the Stewardship Responsibility Activity Guidelines," adding, "Rather than the SRC, which is highly susceptible to government directives, public opinion, and pressure from civic groups, the Fund Management Headquarters responsible for fund operations should make these decisions." He further criticized, "Leaving it to the committee is a typical case of shirking responsibility in a 'committee republic.'"

Professor Kim Dae-jong of Sejong University also emphasized, "The SRC's shareholder derivative lawsuits will follow public opinion trends regardless of profitability," and stressed, "The Fund Management Headquarters should assess the validity of lawsuits and proceed accordingly, establishing specific litigation criteria and adhering to principles to prevent trials by public opinion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)