[Asia Economy New York=Special Correspondent Joselgina] The three major indices of the U.S. New York stock market dramatically closed higher on the 24th (local time) after a ‘rollercoaster’ session swinging between heaven and hell. The market’s wild moves, which saw a nearly 5% plunge during the day before turning to an upward trend just before the close, recall the 2001 ‘dot-com bubble’ period. This is seen as a reflection of the market’s anxiety over early tightening ahead of the Federal Open Market Committee (FOMC) meeting and the uncertainty about the future.

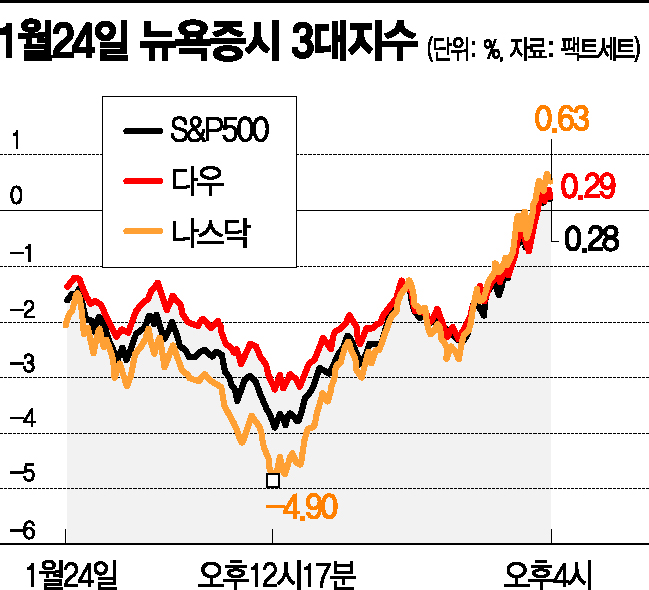

On this day in the New York stock market, the Dow Jones Industrial Average fell more than 1,000 points at one point during the session but rebounded to close at 34,364.50, up 99.13 points (0.29%) from the previous trading day. The large-cap focused S&P 500 index closed at 4,410.13, up 12.19 points (0.28%), and the tech-heavy Nasdaq index ended at 13,855.13, up 86.21 points (0.63%). This marked the first time in a long while that the New York stock market, which had been feared to experience its largest drop since the March 2020 pandemic, stopped its downward trend.

The early session was clearly bearish. This was due to concerns about early tightening by the U.S. central bank, the Federal Reserve (Fed), along with heightened geopolitical risks surrounding Ukraine. Around 12:17 p.m., the Nasdaq index’s decline reached 4.9%. The S&P 500 entered a technical correction phase, falling 10% from its peak, and the Dow dropped as much as 1,115 points. The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), known as Wall Street’s ‘fear gauge,’ surged to the 38 level, the highest since November 2020.

However, the market rebounded in the afternoon. This was due to expectations for the earnings season and a spreading sentiment that the recent risk-asset avoidance was excessive. Marko Kolanovic, JP Morgan’s chief equity strategist, noted in an investor note that "considering technical indicators and market sentiment, this could be the final stage of the correction." There was also a confirmed move to buy recently plummeted tech stocks such as Microsoft (MS), Tesla, and Apple.

Bloomberg News reported that the day’s rollercoaster market moves were "the largest since the dot-com bubble in January 2001." Economic media CNBC stated, "The Nasdaq index closing higher after falling more than 4% intraday is the first since the 2008 financial crisis."

Investors are now focusing on hints about the timing and magnitude of the base rate hike that Fed Chair Jerome Powell will announce at the FOMC meeting on the 25th-26th. Bloomberg News reported, "Despite the recent sharp market decline, the Fed will not break its rate hike stance," explaining that "for the Fed, employment and price stability remain more important tasks." Ultimately, the pace of the Fed’s tightening will be determined by the level of inflation. Ann Mileti of Allspring Global Investments predicted, "There will be turmoil in the market for the next few months."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)