Survey Results on Quasi-Tax Burden of Companies by FKI

As of 2020, Total Quasi-Tax Burden on All Citizens Approximately KRW 164.8 Trillion... 8.5% of GDP, 42.5% of Total Taxes

Quasi-Tax Burden on Companies Approximately KRW 72 Trillion... 1.3 Times Corporate Tax in 2020, 62.5% of Corporate Net Profit

[Asia Economy Reporter Jeong Hyunjin] The quasi-taxes borne by domestic companies amount to 62.5% of their annual net income. The scale of quasi-taxes has more than doubled over the 12 years from 2008 to 2020.

On the 25th, the Federation of Korean Industries (FKI) announced this after investigating the current status of quasi-tax burdens forcibly imposed on citizens and companies. Quasi-taxes are not taxes, but they refer to financial burdens that citizens and companies must pay to the state or public institutions, similar to taxes.

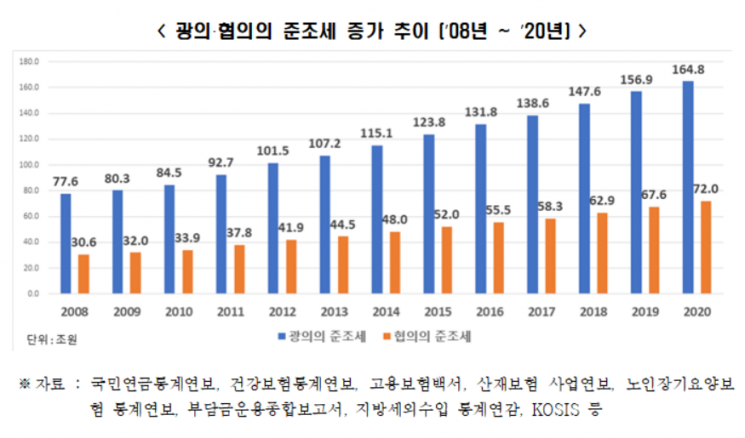

According to the FKI's investigation, as of 2020, the broad quasi-taxes borne by all citizens including companies amounted to approximately 164.8 trillion KRW, which corresponds to 8.5% of the Gross Domestic Product (GDP) and 42.5% of total tax revenue. The narrow quasi-taxes mainly borne by companies were about 72 trillion KRW, which is 1.3 times the corporate tax in 2020 and amounts to 62.5% of companies’ net income.

Examining the trend of quasi-tax increases, broad quasi-taxes rose from 77.6 trillion KRW in 2008 to 164.8 trillion KRW in 2020, about 2.1 times, while narrow quasi-taxes increased from 30.6 trillion KRW in 2008 to 72 trillion KRW in 2020, about 2.4 times. Considering that GDP grew 1.7 times during the same period, the growth rate of quasi-taxes was higher.

Additionally, looking at changes in companies’ net income and narrow quasi-taxes during the same period, narrow quasi-taxes continued to increase even when companies’ net income decreased. Companies’ net income peaked at 188.7 trillion KRW in 2017 after recording 52.5 trillion KRW in 2008, then fluctuated with economic cycles. In contrast, narrow quasi-taxes showed a continuous upward trend regardless of companies’ net income.

Since 2017, as companies’ net income declined and narrow quasi-taxes increased, the ratio of narrow quasi-taxes to net income surged from 30.9% in 2017 to 39.0% in 2018, 60.8% in 2019, and 62.5% in 2020.

Yoo Hwan-ik, head of the Industrial Headquarters at FKI, said, "The continuous increase in quasi-taxes during the economic downturn caused by COVID-19 is a heavy burden on citizens and companies," adding, "A 'quasi-tax management system' should be established to adjust the quasi-tax burden considering the economic situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)