[Asia Economy Reporter Ji Yeon-jin] Last year, 110 initial public offerings (IPOs) were conducted in the domestic stock market, marking a record high. Thanks to the liquidity flowing into the stock market, rights offerings also reached their highest level since 1999, right after the IMF financial crisis.

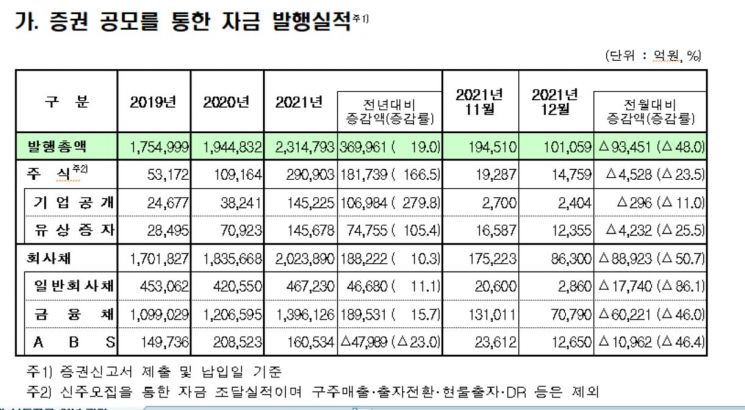

According to the Financial Supervisory Service's announcement on the direct financing performance of companies last year, the total amount of public offerings of stocks and corporate bonds over the year was KRW 231.4793 trillion, an increase of 19% (KRW 36.9961 trillion) compared to the previous year.

The total number of stock public offerings was 199, amounting to KRW 29.0903 trillion, a sharp increase of KRW 18.1739 trillion (165.5%) from the previous year. With 110 IPOs conducted, fundraising through these reached KRW 14.5225 trillion. Compared to 2020, when 87 IPOs raised KRW 3.8241 trillion, this represents an increase of KRW 10.6984 trillion (219.8%), marking an all-time high. The previous record was KRW 5.8893 trillion in 2017.

Last year's public offering frenzy is analyzed to be due to multiple large-scale IPOs exceeding KRW 1 trillion, including Krafton (KRW 2.8008 trillion), KakaoBank (KRW 2.5526 trillion), KakaoPay (KRW 1.5300 trillion), and Hyundai Heavy Industries (KRW 1.0800 trillion). In fact, the 14 IPOs listed on the KOSPI raised KRW 11.3817 trillion. Meanwhile, 96 IPOs on the KOSDAQ raised KRW 3.1408 trillion.

Rights offerings also increased more than twofold from the previous year, with KRW 14.5678 trillion issued across 87 cases last year, compared to KRW 7.0923 trillion from 70 cases the year before. This was driven by active rights offerings from listed companies for operational and refinancing funds, including Korean Air (KRW 3.3160 trillion), Hanwha Solutions (KRW 1.3461 trillion), Samsung Heavy Industries (KRW 1.2825 trillion), POSCO Chemical (KRW 1.2735 trillion), and Hanwha Systems (KRW 1.1607 trillion).

Corporate bond issuance last year amounted to KRW 202.389 trillion, an increase of KRW 18.8222 trillion (10.3%) from the previous year's KRW 183.5668 trillion. As large corporations such as LG Chem (KRW 1.2000 trillion), SK (KRW 1.2000 trillion), SK Hynix (KRW 1.1800 trillion), Korea South-East Power (KRW 1.1400 trillion), Emart (KRW 1.1200 trillion), Korean Air (KRW 970 billion), and Korea Hydro & Nuclear Power (KRW 800 billion) increased their issuance, general corporate bonds totaled 479 cases amounting to KRW 46.723 trillion, up KRW 4.668 trillion (11.1%) from 410 cases and KRW 42.055 trillion the previous year.

However, the issuance volume and proportion of high-grade bonds rated AA or higher decreased (-KRW 9.350 billion, -9.2 percentage points), while lower-grade bonds rated A and BBB or below increased.

Financial bonds numbered 2,194 cases, totaling KRW 139.6126 trillion, an increase of KRW 18.9531 trillion compared to 1,972 cases and KRW 120.6595 trillion the previous year.

As of the end of last year, the total outstanding corporate bond balance was KRW 624.6244 trillion, up KRW 47.6357 trillion from KRW 576.9887 trillion at the end of the previous year.

Issuance of commercial paper (CP) and short-term bonds totaled KRW 1,656.4262 trillion, an increase of KRW 255.412 trillion (18.2%) compared to KRW 1,401.0141 trillion the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)