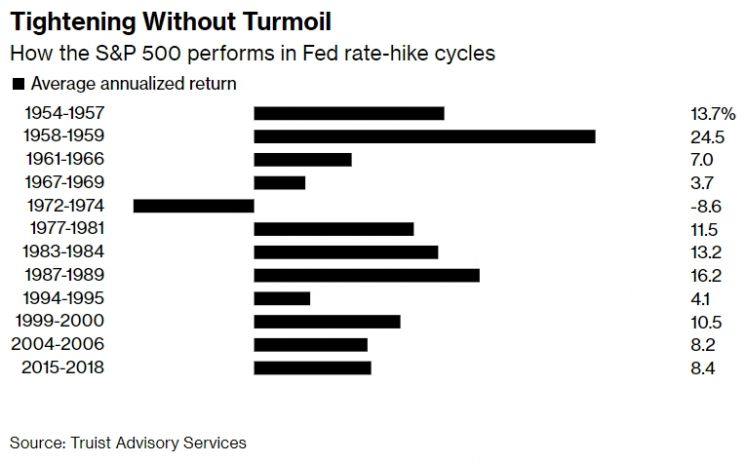

12 Rate Hikes Since 1950... All But One Led to S&P 500 Index Gains

MSCI Emerging Markets Index Up 3.6% in One Month... Goldman Sachs & BNP Paribas Buying

[Asia Economy Reporter Park Byung-hee] The New York stock market plunged last week ahead of the Federal Reserve's (Fed) first Federal Open Market Committee (FOMC) meeting of the year (25th-26th). Investors, worried about liquidity tightening, engaged in sell-offs as expectations grew that the Fed would raise the benchmark interest rate at a considerably rapid pace as early as March.

However, Bloomberg reported on the 23rd (local time) that historically, the New York stock market has risen during periods of Fed interest rate hikes. Bloomberg emphasized that the Fed's rate hikes fundamentally reflect an improving U.S. economy, which in turn reflects increased corporate profits.

According to Truist Advisory Services, since 1950, the S&P 500 index has fallen only once during 12 periods of U.S. benchmark interest rate hikes. During these 12 rate hike periods, the S&P 500 index rose by an average of 9% annually. Even in the most recent rate hike period from 2015 to 2018, the S&P 500 recorded an average annual increase of 8.4%.

The only time the New York stock market declined was during the 1972-1974 rate hikes, which coincided with the U.S. economic recession from 1973 to 1975.

Wall Street also predicts a rise in the New York stock market this year. According to Bloomberg's compilation, Wall Street investment strategists' year-end forecast for the S&P 500 index this year is 4982. This is about 13% higher than the current S&P 500 index and 4.5% higher compared to last year's closing price.

Some point out that the S&P 500 index rose by as much as 26.89% last year without significant corrections. In fact, last year's annual low for the S&P 500 (3662.71) was only 2.49% below the 2020 closing price (3756.07). This indicates a predominantly upward trend without notable pullbacks.

According to Truist, since 1955, there have been ten instances where the S&P 500's annual low declined less than 5% compared to the previous year, as was the case last year. In the following year, the S&P 500 rose seven times and fell three times, with an average increase of 7%. However, the average annual low fell by 13% compared to the previous year, indicating increased volatility.

There is also advice to pay attention to emerging market stocks. While the S&P 500 index recently plunged, the MSCI Emerging Markets Index rose by 3.6% over the past month.

Bloomberg reported that some large global funds, including Goldman Sachs Asset Management and BNP Paribas Asset Management, are buying emerging market stocks. This is because emerging countries had already preemptively raised their benchmark interest rates last year, reducing the need for rate hikes this year, thereby creating a more favorable environment for emerging market stocks compared to the U.S. market, where strong rate hikes are expected.

Daniel Morris, Chief Investment Strategist at BNP Paribas Asset Management, said, "We began increasing our allocation to emerging market stocks starting November last year." He explained, "While the Fed may raise rates much more than the market expects this year, many emerging market central banks have already raised rates significantly, which could be more supportive of their stock markets in the short term."

Goldman Sachs Asset Management also stated in a report, "Emerging market economies may show stronger growth trends this year," adding, "The growth rate gap between developed and emerging markets is currently at its lowest in at least 20 years, but this gap is expected to start widening again this year."

The fact that the price-to-earnings ratio (PER) is undervalued is also positive for emerging market stocks. According to Bloomberg's data, the current PER of the MSCI Emerging Markets Index, reflecting 12-month earnings estimates, is about 12.4 times. This is approximately 40% lower than the S&P 500's PER of around 20 times, marking the largest gap since 2007.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)