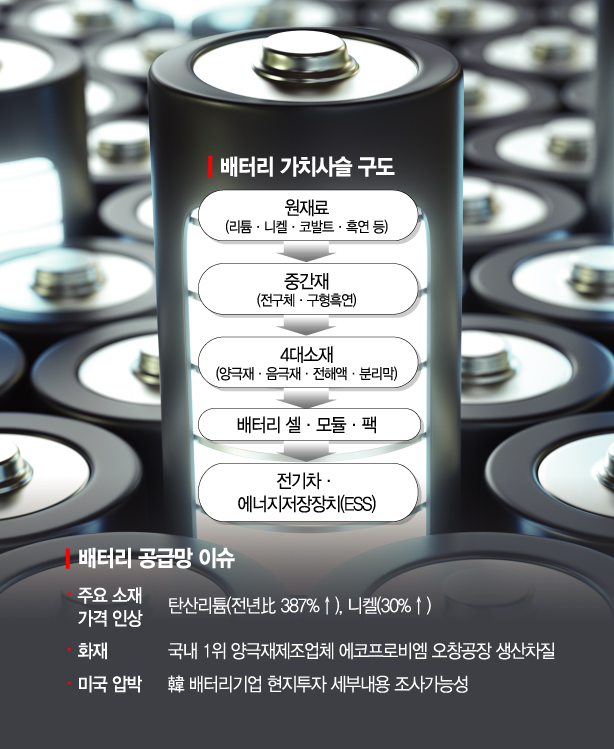

Raw Material Price Surge and Supply Volatility

Production Disruption Due to Anode Material Plant Fire

US Administration May Demand Sensitive Information

Such as Supplier and Customer Lists for Operating Permits

[Asia Economy Reporter Choi Dae-yeol] Negative factors that could adversely affect the secondary battery (battery) industry have been emerging one after another since the beginning of the year. Amid increased supply-demand volatility due to the sharp rise in major raw material prices since last year, a fire broke out at a cathode material production plant, one of the four major battery materials. Additionally, concerns are growing as there is talk of possible pressure within the United States, where domestic battery companies have been making their most intensive investments over the past 1-2 years. With the full-scale expansion of electric vehicle adoption expected to significantly increase battery demand this year, the industry is closely monitoring whether this will escalate into supply disruptions.

According to the industry on the 24th, the recently fire-affected EcoPro BM Ochang plant mainly produces high-nickel (NCA) cathode materials used primarily for batteries in small home appliances. Since establishing a new plant in Pohang in 2019, the company has been producing a significant portion of electric vehicle battery cathode materials at the new facility. The annual production capacity of the affected plant line is about 17,000 tons, whereas the Pohang plant reportedly has dedicated lines for major battery company clients such as Samsung and SK, each with a capacity of around 26,000 tons per line.

Lee Jong-hyung, a researcher at Kiwoom Securities, said, "It will take time to determine whether the plant can resume operations due to the personnel accident," but predicted that the damage and production disruption caused by the fire would be somewhat limited. However, since the Pohang plant will have to take on some of the volume that was supposed to be produced at the fire-affected plant, some interference in scheduling and volume adjustments is inevitable. Cathode materials are the most important intermediate goods directly linked to electric vehicle performance and lifespan, and EcoPro BM is the company with the largest cathode material production volume in Korea.

There are also concerns that negative factors originating from the U.S. administration could hamper progress. U.S. President Joe Biden has been demanding customer lists from semiconductor companies investing locally, indicating a high likelihood of requesting more detailed information across the entire supply chain. The English-language media outlet Digitimes, based in the Greater China region, recently reported, "There is market interest in whether the U.S. government will scrutinize suppliers as meticulously as it did semiconductor manufacturers last year," adding, "The U.S. government may ask Korean battery companies for information on raw material suppliers, sources of funding, stakeholders, and patent disputes in exchange for operating permits within the country."

Since taking office, President Biden has ordered special inspections of semiconductor and battery supply chains, approaching certain domestic industries from a security perspective. Given the significantly increased usage of batteries, this implies that Korean companies actively investing locally may face pressure. Battery usage is rapidly expanding due to decarbonization movements centered on major advanced countries and the increased adoption of electric vehicles and energy storage systems (ESS).

The U.S. has also offered various incentives and tax benefits to build a domestic battery ecosystem. This can be interpreted as a signal that ‘carrots’ may soon be accompanied by ‘sticks’ to expand local battery production networks. Like semiconductors, battery-related product information is sensitive, and considering the U.S. has already signaled a technological hegemony competition with China, this scenario is quite foreseeable. The fact that Korean battery companies such as LG, SK, and Samsung are currently investing trillions of won in the U.S. adds to the burden.

An industry insider said, "Following the historic rise in battery prices last year due to raw material supply difficulties, various issues have sporadically emerged throughout the entire supply chain," adding, "Considering the competition with upstream industries to seize market leadership, the situation is far from easy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)