Stock Price Plummets Over 20% Within a Day After Earnings Announcement

[Asia Economy Reporter Minji Lee] Netflix, an online video streaming service (OTT) provider, plunged more than 20% in a single day amid forecasts that subscriber growth in the first quarter could sharply slow down. Securities experts predicted that hit content and success in mobile gaming are necessary for a stock rebound.

On the 23rd, Netflix's stock price stood at $397.50, down 33.46% since the beginning of the year. It is analyzed that many investors sought to sell their shares as the key indicator determining stock direction?the subscriber growth rate?stalled.

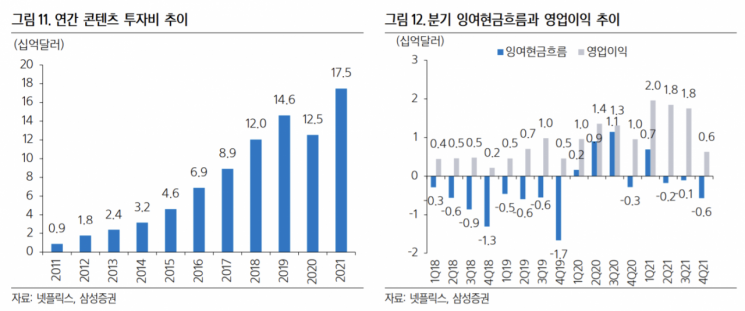

In the fourth quarter, Netflix's revenue was $7.71 billion, up 16% year-over-year, while operating profit fell 34% to $630 million. Earnings per share (EPS) rose 11.8% from a year earlier to $1.33. Revenue met market expectations, but EPS exceeded consensus.

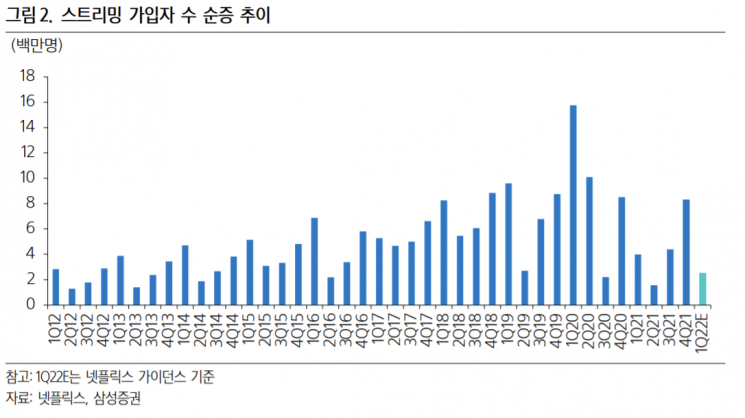

Subscriber numbers fell short of expectations. The net subscriber increase in Q4 was 8.28 million, missing both the guidance (8.5 million) and the lowered market forecast (8.3 million). By region, net subscriber additions were 3.54 million in Europe, the Middle East, and Africa; 2.58 million in Asia; 1.19 million in the U.S. and Canada; and 970,000 in Latin America. Although the quarter started strongly with the record-breaking hit “Ojingeo Geim” (Squid Game), subscriber growth slowed from late October to early December before releases like “Emily in Paris Season 2,” “The Witcher Season 2,” and “Don’t Look Up” at year-end. Minha Choi, a researcher at Samsung Securities, said, “The revenue growth rate outpaced subscriber growth as the average subscription fee rose by 7%. The price increase appears to reflect confidence in existing content and user loyalty, indicating that cancellations are unlikely to be significant.”

The company also provided a first-quarter net subscriber guidance of only 2.5 million, far below the market estimate of 7.25 million. This is presumed to be influenced by the delayed global economic recovery and the expected releases of “The Adam Project” and “Bridgerton Season 2” toward the end of the quarter. Researcher Choi explained, “Netflix has shown excellent performance due to its content competitiveness, so the somewhat disappointing guidance is likely to keep the stock weak in the short term.”

A global hit work is needed for a stock rebound. The company is currently increasing investment in content through various methods. Collaborating with local operators to expand original content, titles like “Ojingeo Geim” (Squid Game) and “Lupin” have gained worldwide popularity beyond their production countries and are being produced as series. Minha Choi said, “The Korean original ‘Jongi-ui Jip: Gongdong Gyeongjeguyeok’ (Money Heist: Korea ? Joint Economic Area) and the spin-off series starring the character ‘Berlin’ are expanding the universe of the original ‘Jongi-ui Jip’ (Money Heist). This active strategy to increase the utilization of popular IPs is promising.”

The performance of mobile games also deserves attention. In August last year, Netflix officially announced its entry into the gaming sector, and the following month acquired game developer Night School Studio, marking its first step into the gaming market. After testing in some countries, from November, users worldwide could enjoy mobile games on the Netflix app. The gaming business is expected to accelerate this year. Minha Choi predicted, “Ten games were released last year, and next year we expect portfolio expansion with a variety of genres including casual and core games. The performance of mobile games utilizing owned IPs will be another variable affecting the stock price.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)