[Asia Economy Reporter Ji Yeon-jin] This year, housing demand is expected to exceed supply, leading to a rise in house prices.

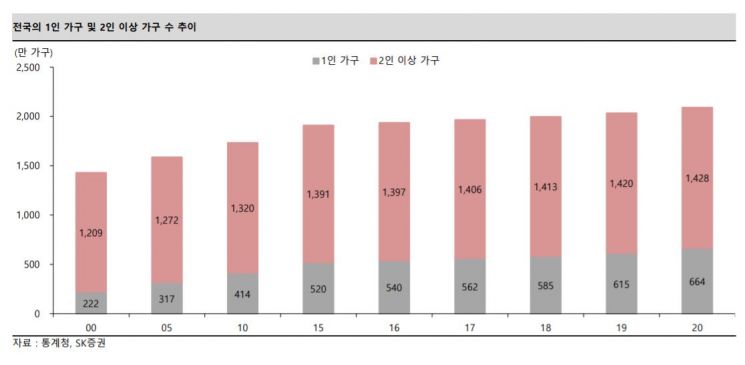

According to the report "THE Real Estate 2022 Outlook: Polarization Driven by Valuation" published by SK Securities on the 23rd, the total number of households nationwide was 20.92 million in 2020, an increase of 1.81 million households compared to 19.11 million in 2015. This means an average of 360,000 new households were created annually.

Of the 20.92 million households nationwide in 2020, single-person households accounted for 6.64 million, representing 31.7% of the total. The total number of households increased by 580,000 from 2019 to 2020, of which 490,000 were single-person households. The rapid increase in households is presumed to have resulted from the diversification of single-person households.

If this trend continues, more than 100,000 new households will be added in Seoul, 200,000 in Gyeonggi, and 150,000 in metropolitan cities, indicating a need for new residential spaces.

Researcher Shin Eol of SK Securities pointed out, "In an era of real asset inflation, there is a hedge demand against the decline in currency value. In the past, when policies to suppress demand were implemented, real estate price increases were inevitable, and in that context, attention should be paid to the influx of new demand." He added, "When defining actual demanders as one household owning one house, the growth rate of households accelerates. Especially, among new households in Seoul, the rate of occurrence of households without housing compared to those with housing is faster."

He continued, "Single-person households nowadays also pursue quality of residence, unlike before. Considering the insufficient supply of apartments, this deepens the supply-demand mismatch," adding, "The nationwide sharp decline in unsold units and apartment move-in volumes below the average support the notion that this year’s real estate market is in a demand phase exceeding supply."

The real estate market is facing an inflation environment changed before and after the COVID-19 pandemic. Inflation in real assets has already begun. Last year, domestic land prices are expected to have risen by about 4%. For eight consecutive years, both the inflation target level of 2% and the consumer price index increase rate have been exceeded simultaneously.

The housing market was the hottest since the year of the 2002 World Cup. Last year, the housing sales and jeonse (long-term lease) indices surged by 14.97% and 9.38%, respectively. Although the government’s real estate policies failed to achieve the targeted price decline, transactions cooled down. Housing transactions decreased by about 20%, while non-residential building transactions reached the highest annual volume.

Researcher Shin said, "Last year was the first year of valuation investment," and added, "This year is expected to be a year of discerning the wheat from the chaff beyond valuation."

The nationwide housing sales index is expected to rise by about 8%, with average prices projected to increase by 12% for sales and 16% for jeonse. With the new government scheduled to take office in May this year, real estate policies will change again, which is considered a volatility factor. Especially, it is time to reevaluate the three lease laws related to new jeonse demand using the right to request contract renewal. Researcher Shin stated, "There is a possibility that the side effects of extending lease periods during the Roh Tae-woo administration could be repeated, and the decrease in supply of new and existing housing units, along with the Korean real estate market trailing the U.S., will serve as key bases for the outlook."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)