Hankyung Research Institute, 'Analysis of the Impact of International Raw Material Price Surge on Corporate Profitability and Producer Prices'

[Asia Economy Reporter Kim Heung-soon] Last year, with international raw material prices soaring by more than 40%, import prices of raw materials surged, exerting an upward pressure of 5.7 percentage points (p) on producer prices, and corporate operating profit margins declined by 2.3%p annually, posing a significant burden on the macroeconomy and corporate profitability, according to a recent study.

The Korea Economic Research Institute (KERI), under the Federation of Korean Industries, announced this on the 23rd through its analysis titled "Impact of International Raw Material Price Surge on Producer Prices and Corporate Profitability and Its Implications."

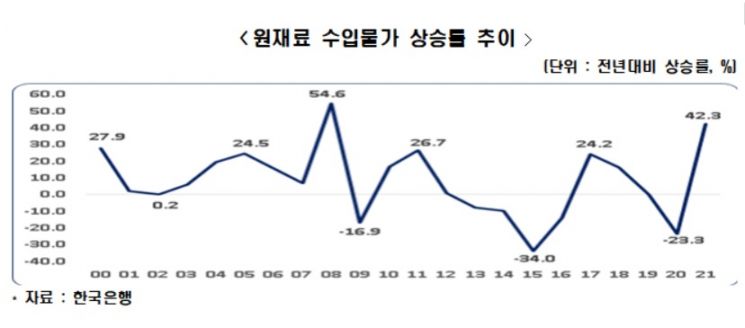

Last Year Raw Material Import Prices Soared 42.3%, Largest Increase Since 2008

According to KERI, import prices rose by 17.6% year-on-year in 2021, with the raw material import prices among the components of import prices increasing the most at 42.3%. This rate of increase in raw material import prices is the highest in 13 years since the global financial crisis in 2008, when it was 54.6%.

KERI analyzed that the sharp rise in raw material import prices in 2021 was due to the steep increase in international raw material prices, centered on international crude oil. Last year, international crude oil prices rose between 51.4% (Brent crude) and up to 58.7% (WTI - West Texas Intermediate) based on spot prices. Non-ferrous metal prices also surged significantly, with aluminum up 42.2% and zinc up 31.5%, while major grain prices increased based on futures prices, with corn rising 22.6% and wheat 20.3%.

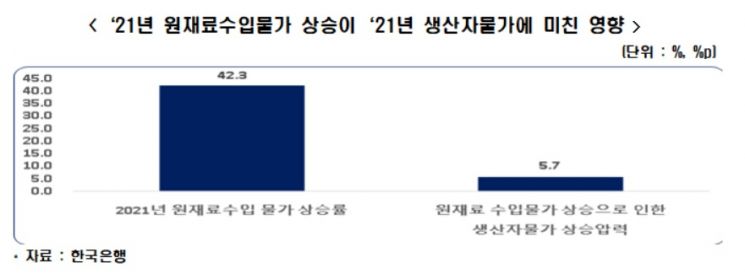

Producer Prices Also Rise by 5.7%p

If Half of Raw Material Price Increase is Absorbed by Companies, Operating Profit Margin Drops by 2.3%p

KERI's analysis of the impact of raw material import price increases on producer prices found that a 1%p rise in raw material import prices leads to a 0.134%p increase in the producer price inflation rate. Applying this result on an annual basis, the 42.3% surge in raw material import prices last year had the effect of raising producer prices by 5.7%p in 2021.

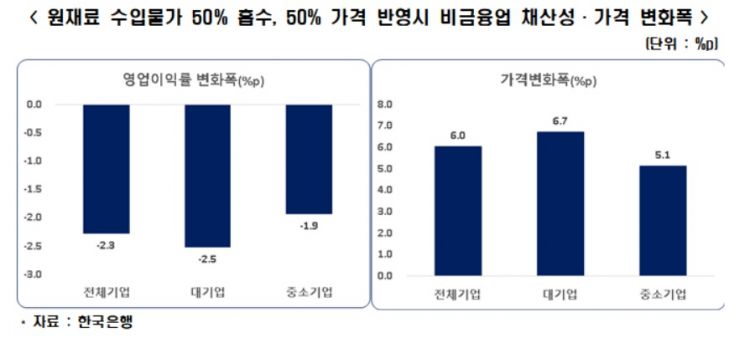

KERI also analyzed the impact of international raw material price increases on corporate profitability under the assumption that companies absorb half of the raw material import price increase themselves and pass the remaining half on to product sales prices. The results showed that the operating profit margin on sales for all non-financial sector companies averaged 5.1% during the five years before COVID-19 (2016-2020), but dropped to 2.8% after the rise in international raw material prices, a decline of 2.3%p annually. Additionally, due to companies passing on prices, the prices of goods and services produced rose by 6.0%p.

The decline in operating profit margin by company size was greater for large corporations at -2.5%p compared to -1.9%p for small and medium enterprises. KERI analyzed that large corporations are more affected by international raw material price increases because they have a higher proportion of material costs relative to sales.

Choo Kwang-ho, Director of Economic Policy at KERI, emphasized, "Korea has a high import ratio of raw materials such as crude oil and non-ferrous metals, so when international raw material prices rise, domestic inflationary pressure inevitably increases. To minimize the impact of recent international raw material price surges on the domestic macroeconomy and corporate profitability, it is necessary to alleviate import price pressures as much as possible through stable securing of key raw material supply chains, reduction of import tariffs, and support for international logistics."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)