Class Action Lawsuits, Subscribers Win Consecutively

Insurance Companies 'Hand' in Individual Lawsuits

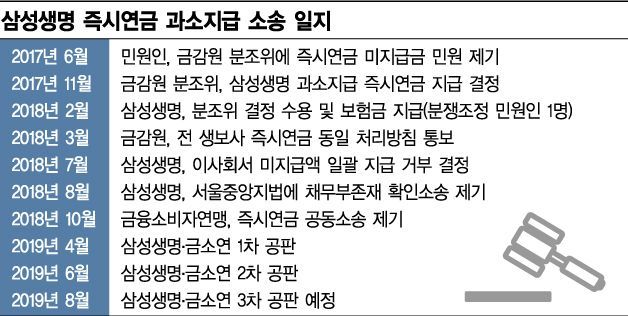

[Asia Economy Reporter Oh Hyung-gil] The court has once again ruled in favor of the plaintiffs in a class-action lawsuit filed by Samsung Life Insurance immediate annuity subscribers demanding the return of unpaid amounts.

The 45th Civil Division of the Seoul Central District Court ruled in favor of the consumer plaintiffs in two class-action lawsuits filed against Samsung Life Insurance on the 19th, claiming unpaid immediate annuity refunds. There are a total of 18 consumer plaintiffs in this class-action lawsuit.

An immediate annuity is a product where the subscriber deposits a lump sum and receives monthly insurance payments in the form of an annuity starting one month later. The plaintiffs are subscribers of the 'inheritance maturity type' immediate annuity, which refunds the principal upon maturity after receiving annuity payments for a certain period.

The subscribers argued that the payments did not meet the 'minimum guaranteed interest rate' explained by Samsung Life Insurance at the time of subscription. To prepare funds for maturity refunds, Samsung Life Insurance has been paying annuities after deducting a portion from the amount calculated by applying the declared interest rate to the net premium, but the subscribers claim that such deductions were not specified in the policy terms.

The core issue in this lawsuit is whether the content recorded in the explanatory document (calculation method document), rather than the policy terms, has the same effect as the policy terms.

Previously, the Korea Financial Consumer Federation (KOFCO) gathered subscribers and filed a class-action lawsuit in 2018, claiming that life insurance companies including Samsung Life Insurance arbitrarily deducted maturity refund funds from immediate annuity subscribers and paid less insurance money.

Among the lawsuits filed so far, all four class-action lawsuits against Kyobo Life Insurance, Tongyang Life Insurance, Mirae Asset Life Insurance, and Samsung Life Insurance resulted in consumer victories in the first trial. Since the losing insurers appealed the first trial verdicts, it is expected to take considerable time before a final conclusion is reached.

The second trial lawsuit for the unpaid immediate annuity refund, in which Samsung Life Insurance previously lost, began at the Seoul High Court on the 20th.

On the other hand, in a consumer individual lawsuit filed last October against Samsung Life Insurance and Hanwha Life Insurance, the insurers won. An insurance company official said, "We have no special position regarding the lawsuit results," and added, "We will actively participate in the lawsuit to receive a fair judgment."

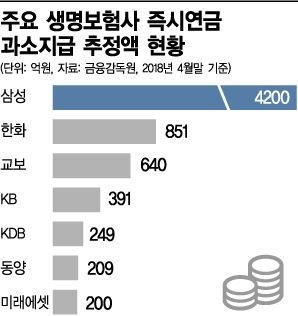

Meanwhile, the Financial Supervisory Service identified in 2018 that the unpaid immediate annuity amounts reached up to 1 trillion KRW, with 160,000 subscribers. Among them, Samsung Life Insurance had the largest number with 50,000 subscribers and 400 billion KRW. Hanwha Life Insurance and Kyobo Life Insurance were identified with 85 billion KRW and 70 billion KRW, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)