Foreign Media Identify Foundry and Design as Essential to Achieving No.1 System Semiconductor Goal by 2030

The Samsung flag is fluttering in the wind in front of the Samsung Electronics Seocho building. Photo by Moon Honam munonam@

The Samsung flag is fluttering in the wind in front of the Samsung Electronics Seocho building. Photo by Moon Honam munonam@

[Asia Economy Reporter Kim Heung-soon] An analysis has emerged that major semiconductor companies worldwide are strategically investing to gain dominance in the automotive semiconductor market. Samsung Electronics' success in achieving its goal of becoming the world's No. 1 system semiconductor company by 2030 is expected to hinge on its development of advanced chips in this field and securing foundry (semiconductor contract manufacturing) clients.

According to business circles and foreign media on the 21st, Taiwan's TSMC, the global leader in foundry market share, is currently building new production lines or discussing establishment in places such as Arizona in the United States, Kumamoto in Japan, and Germany. Taiwanese media 'Digitimes' pointed out, "It is highly likely that the decision to build foundry factories in these regions was made with customers in the automotive industries of the U.S., Japan, and Germany in mind."

TSMC Builds Production Lines in U.S. and Japan

Intel Announces Factory Establishment in Europe

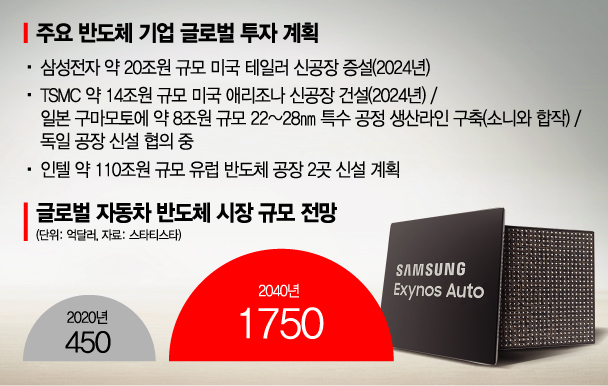

Specifically, TSMC is investing $12 billion (approximately 14.4 trillion KRW) to build a fab (production plant) in Arizona, USA. Scheduled for completion in 2024, this facility will mass-produce chips using a 5nm (1nm = one-billionth of a meter) process. The industry views this investment as targeting the next-generation automotive semiconductor market, which requires 2,000 to 3,000 chips for autonomous and electric vehicles. In Japan, TSMC plans to invest about 8 trillion KRW to establish a 22-28nm special process production line in partnership with Sony. Last year, initial negotiations were held with the German government for establishing a semiconductor factory.

Intel, re-entering the foundry business, has declared it will invest €80 billion (approximately 110 trillion KRW) to build two semiconductor factories in Europe, with one expected to be in Germany. Intel’s investment plan also focuses on securing competitiveness in the next-generation automotive semiconductor market. Intel CEO Pat Gelsinger emphasized, "The future of automobiles depends on electric and autonomous vehicles, and semiconductor technology is ultimately the core."

Samsung Also Invests in Taylor City

Expected to Seek Collaboration with Tesla on Electric Vehicles

Foreign media analyzed that Samsung Electronics' investment in a new foundry plant in Taylor City, USA, confirmed last year, is also aimed at exploring future electric vehicle business opportunities with Tesla. The facility, scheduled for completion in 2024 with an investment of about 20 trillion KRW, is expected to introduce the most advanced 3nm semiconductor process.

As of the third quarter of last year, Samsung Electronics holds a 17.1% share of the global foundry market, ranking second. It is known that the over 100 clients secured so far are mostly related to mobile and IT products. To narrow the gap with TSMC, which has about 500 clients, securing the rapidly growing automotive semiconductor market is crucial. Market research firm Statista predicts the global automotive semiconductor market will grow from $45 billion (approximately 52 trillion KRW) in 2020 to $175 billion (approximately 204 trillion KRW) by 2040.

Samsung Electronics is also strengthening its automotive electronics business by leveraging its world-leading memory semiconductor capabilities to design automotive semiconductors. Representative examples include advanced automotive memory solutions such as high-performance solid-state drives (SSD) and graphics DRAM unveiled in December last year. Prior to this, Samsung released three types of advanced automotive system semiconductors: 5G-based ultra-high-speed communication chips, high-performance processors for infotainment, and power semiconductors. It also supplies the next-generation infotainment system processor ‘Exynos Auto’ to automakers such as Audi and Volkswagen.

An industry insider said, "Samsung Electronics is currently reluctant to enter the automotive semiconductor field, which is experiencing supply shortages, due to issues such as profitability, passing safety standards, and securing clients," but added, "Because the next-generation automotive semiconductor market has great growth potential, Samsung will accelerate related investments and research and development to defend its position."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)