Compared loan products on 3 platforms

Lowest interest rate is Hana Bank's 'Hana One Q Credit Loan' at 6.40%

Pepper Savings Bank offers highest limit with 64.5 million KRW

Many rejected for loans at 1st and 2nd tier banks despite average salary

Loan regulations tightened this year... borrowing money expected to be harder

As a result of checking interest rates and limits through a loan product comparison platform, it was found that even office workers earning an average annual salary were rejected by dozens of financial institutions. There are concerns that due to the impact of household debt volume regulations implemented by financial authorities, not only low-credit and low-income individuals but also the majority of office workers are experiencing a 'financial blockage' phenomenon.

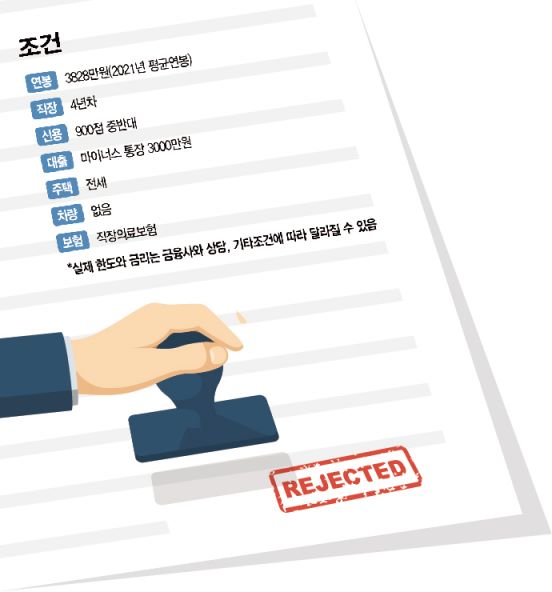

On the 21st, a reporter from this paper personally used loan product comparison services provided by three financial companies and fintech firms, and it was identified that up to about 40 financial institutions rejected the loan applications. The loan screening conditions assumed an annual salary of 38.28 million KRW, which was the average salary per person according to the '2021 National Tax Statistics Yearbook' announced by the National Tax Service. It was also assumed that the applicant was a 4-year office worker with a 30 million KRW overdraft account, living in a jeonse (key money deposit) rental, no vehicle, and covered by workplace health insurance.

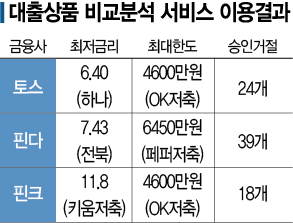

Among the three, the platform offering the lowest interest rate was Toss. Toss has partnerships with 41 banks, including major banks such as Shinhan, Hana, Woori, and SC First Bank, providing related services. Among these, one could use Hana Bank’s ‘Hana One Q Credit Loan’ with an interest rate of 6.40% and a loan execution amount up to 8.3 million KRW. By increasing the interest rate by about 1 percentage point, it was also possible to borrow 24 million KRW at 7.76% interest from Kyobo Life Insurance. The maximum limit was 46 million KRW with OK Savings Bank’s personal credit loan product, which had an interest rate of 16.1%.

The platform with the largest loan limit was Finda, which provides loan information from 52 financial institutions. It showed that one could borrow a total of 64.5 million KRW at an 11.3% interest rate through Pepper Savings Bank’s credit loan product. Online investment-linked finance company PeopleFund also offered a credit loan product for office workers up to 50 million KRW at a 15.9% interest rate. The lowest interest rate was 7.43% for Jeonbuk Bank’s ‘JB Proud Loan’ product, but the limit was relatively low at 3.2 million KRW compared to other financial products.

Numerous loan rejections from primary and secondary financial institutions... "It will be even harder to borrow money in the future"

At Fink, which partners with 33 financial institutions, savings banks offered the lowest interest rates. The lowest interest rate was 11.8% for Kiwoom Savings Bank’s mid-interest credit loan and Eugene Savings Bank’s mobile automatic loan product. The limits were 38.28 million KRW and 38.2 million KRW, respectively. The maximum limit was 46 million KRW (16.1%) with OK Savings Bank’s personal credit loan product.

Although interest rates and limits varied by platform, the number of financial institutions that notified rejections reached dozens. Fink reported 18, Toss and Finda each reported 24 and 39 financial institutions respectively as difficult to obtain loans from. Loan rejections occurred evenly across primary banks targeting high-credit customers and secondary financial institutions serving mid- to low-credit customers. At Fink, regional banks, Woori Card, and SBI Savings Bank rejected loans; Toss saw rejections from Shinhan, Woori, SC First Bank, KB, NH, and Sangsangin Savings Bank; and Finda also experienced rejections from savings banks, online investment-linked finance companies, and card companies.

Related companies explained that the differences in loan rejection and loan limit interest rates are due to differences in internal algorithms. A representative from a loan product comparison platform operator said, "If you actually link a joint (financial) certificate and then use the service, the limit, interest rate, and loan approval status may differ," emphasizing, "Differences arise because credit scoring systems (CSS) and dedicated network lines vary."

This has raised concerns that the loan cliff problem for the majority of citizens is worsening as a side effect of debt management policies implemented by the government and financial authorities, such as household debt volume regulations. Even considering that this is a simulated inquiry result, a person with an average income and a high credit score was notified of loan rejections from dozens of primary and secondary financial institutions.

With strong financial regulatory policies additionally announced for this year, the loan cliff phenomenon is expected to deepen gradually. Starting this month, individual DSR (Debt Service Ratio) regulations will apply if the total loan amount exceeds 200 million KRW. From July, DSR regulations will be applied starting from total loan amounts exceeding 100 million KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)