COVID-19 Impact Was Temporary... Short-Term Rental Car Operating Profit Rises for Third Consecutive Year

The used car market is rapidly growing. The global semiconductor shortage that has persisted since the second half of last year caused delays in new car deliveries, leading to an increase in used car prices and sales volume. According to market research firm Frost & Sullivan, the domestic used car market size grew from 32 trillion won in 2015 to 39 trillion won in 2020. It is projected to reach 50 trillion won by 2025. With Hyundai Motor Company and Kia Motors preparing to enter this market, which was once dominated by small and medium-sized enterprises, competition is expected to intensify. Asia Economy analyzed the current status and future growth potential of SK Rent-a-Car, which is showing rapid growth in the used car business, and K Car, a newly listed company strong in online sales.

[Asia Economy Reporter Park So-yeon] SK Rent-a-Car operates primarily in car rental and used car sales. It ranks second in the industry by number of registered vehicles, holding a 12.7% market share. SK Networks is the largest shareholder, with a 72.95% stake as of the end of September 2021.

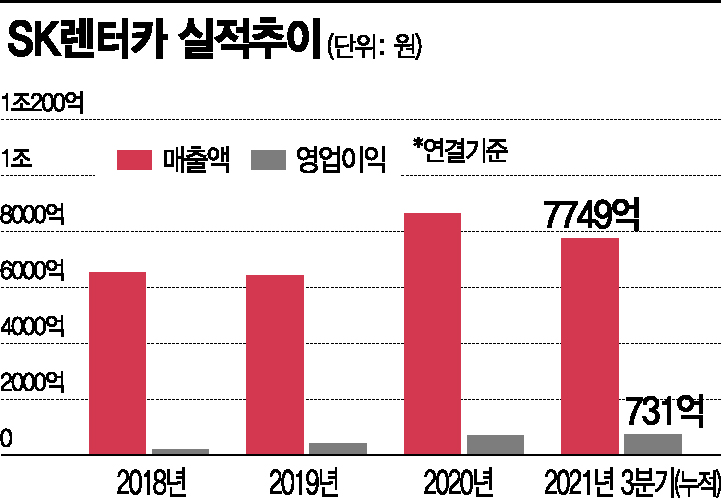

SK Rent-a-Car recorded steady sales of around 600 billion won from 2016 to 2019. Sales jumped to 860 billion won in 2020. Although it was temporarily impacted immediately after the outbreak of COVID-19, demand for travel to Jeju Island surged following the government's easing of social distancing measures, resulting in a short-term boom in the rental car segment.

The securities industry estimates that SK Rent-a-Car surpassed 1 trillion won in sales last year. The consensus among securities firms for SK Rent-a-Car’s 2021 sales is 1.0141 trillion won. Operating profit has also increased sharply over the past three years: 21.8 billion won in 2018, 41.5 billion won in 2019, and 70.8 billion won in 2020. The operating profit forecast for 2021 is 91.6 billion won.

As of the third quarter of 2021, cumulative sales amounted to 774.9 billion won. During the same period, 71.1% (551.1 billion won) of sales came from the rental segment, and 25.6% (198.2 billion won) from used car sales. With the transition to the With-Corona era, short-term rentals showed strong performance due to increased travel demand. The long-term rental segment is also performing better than expected, thanks to securing corporate clients using the SK brand.

The used car segment is also growing. The rise in used car prices due to COVID-19 has positively impacted used car sales revenue. Unless the vehicle semiconductor supply issue is resolved, the strong performance in the used car segment is expected to continue. The increase in used car prices at the time when the shift to electric vehicles is accelerating is also considered a positive factor for improving performance. However, while the entry of automakers into the used car market has increased market trust, competition is expected to become fiercer.

SK Rent-a-Car is transforming into an eco-friendly electric vehicle (EV) rental specialist in line with SK Group’s ESG (Environmental, Social, and Governance) strategy. In September last year, EV rental sales surpassed 3,000 units. The company plans to build the largest dedicated EV complex in Korea on Jeju Island. The goal is to establish a 7,200 kW charging facility capable of charging 3,000 electric vehicles.

In the Jeju project, after establishing the EV Park in the second half of 2022, SK Rent-a-Car plans to convert all rental cars to EVs by 2025. Additionally, through the expansion of the EV vehicle management solution ‘Smart Link,’ the company is collecting driving and battery data and is considering launching a new battery rental business.

The rapid increase in facility investment costs during the transition and acceleration of eco-friendly business is a concern. From 2018 to 2020, facility investments were at the level of 2 to 4 billion won annually. Securities firms expect SK Rent-a-Car to invest between 300 billion and 500 billion won annually from 2021 to 2023.

Interest-bearing debt has also increased sharply, rising from 803.8 billion won in 2018 to 1.545 trillion won in 2020. During the same period, the debt ratio remained around 375-380%. The price-to-book ratio (PBR) was 1.1 times in 2018, 1.19 times in 2019, and 0.89 times in 2020.

Park Jong-ryeol, a researcher at Hyundai Motor Securities, said in a recent report, "With the continued strong performance of long-term rentals and short-term rentals driven mainly by Jeju Island, SK Rent-a-Car is expected to record favorable growth. Despite additional advertising expenses, operating profit is expected to exceed sales growth rate due to improved profitability in rental and used car sales segments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)