Investment in Mining Shares... Diversification from China to Australia

Raw Material Costs Linked to Finished Vehicle Supply Prices

Long-term Purchase Contracts for Key Materials... Minimizing Price Volatility

[Asia Economy Reporter Hwang Yoon-joo] As the prices of key raw materials for batteries surge, the industry is making every effort to defend against cost increases. The demand for batteries is expanding in various fields such as home appliances, electric vehicles, and energy storage systems (ESS), causing raw material prices to soar. Factors like COVID-19 and the global supply chain restructuring have further increased the volatility of raw material prices. While the industry responded over the past 3 to 4 years by linking raw material costs to battery prices, recently battery companies have been directly signing supply contracts with mining companies or investing in mining shares. This is a strategy to reduce volatility from the raw material stage.

LG Energy Solution attracted attention when it was revealed on the 12th that it signed a five-year supply contract starting in 2024 with Australian mining company Liontown for 700,000 tons of lithium concentrate. Lithium concentrate (ore) is the raw material for lithium hydroxide, a key component of electric vehicle batteries. This contract is notable as it symbolically shows the gradual diversification of battery supply chains away from dependence on China. South Korea imports 83.5% of its lithium hydroxide from China. Cobalt and manganese sulfate imports from China reach 87% and 99%, respectively. Although China does not produce all raw materials, it processes raw materials imported from around the world and supplies them to various countries. Many battery material companies both domestically and globally trade with Chinese local companies.

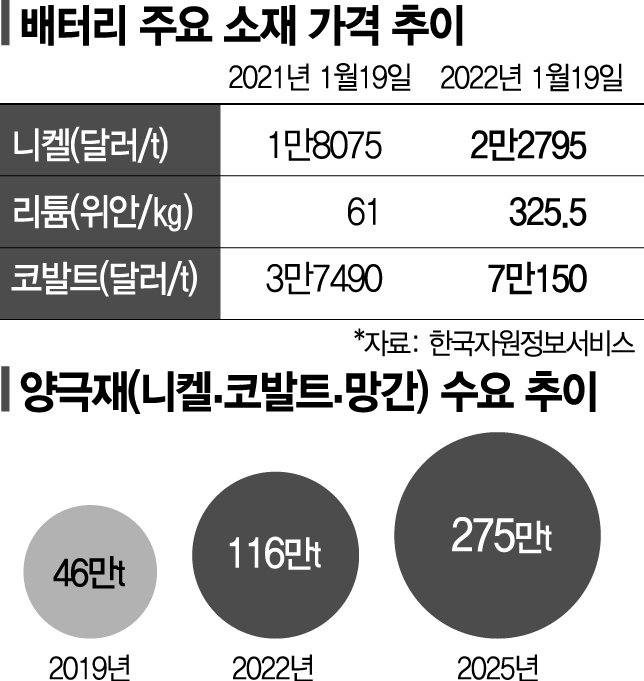

Domestic battery companies have been actively diversifying their raw material supply chains for the past 1 to 2 years due to soaring prices. According to the Korea Resources Information Service, nickel prices reached $22,795 per ton (as of the 19th), the highest level since 2012. During the same period, lithium carbonate rose to 325.5 yuan per kilogram, more than five times the price a year earlier (61 yuan). Recently, graphite prices, one of the anode materials, have also been rising. The fact that even easily obtainable graphite prices have increased indicates the severity of the raw material supply shortage, according to industry insiders.

Efforts to defend against raw material cost surges began around 2019. Until then, battery companies delivered batteries at contracted prices despite sharp increases in key raw material prices, absorbing losses. However, when cobalt prices nearly tripled from $32,900 per ton at the end of 2016 to $91,500 per ton in April 2018, the situation changed. Automakers also began linking battery prices to raw material prices to secure stable supplies.

Furthermore, the battery industry is increasing its bargaining power with key material companies. They sign long-term purchase contracts with core material companies such as cathode and anode material manufacturers to minimize raw material price increases. Cathode material prices are the most sensitive to rises in battery raw material prices such as nickel, lithium, and cobalt. When the prices of the four major raw materials?lithium, cobalt, nickel, and copper foil?increase by 10%, cathode materials rise by 8%, and battery packs, which bundle battery cells, increase by 1.5%. An industry insider said, "Lowering battery prices is the industry's most important issue. As global supply chains are restructured and raw material price volatility increases, investing in mines to secure stable raw materials is becoming common."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.