Kookmin and NongHyup Banks Also Raise Deposit Product Interest Rates by Up to 0.4%P

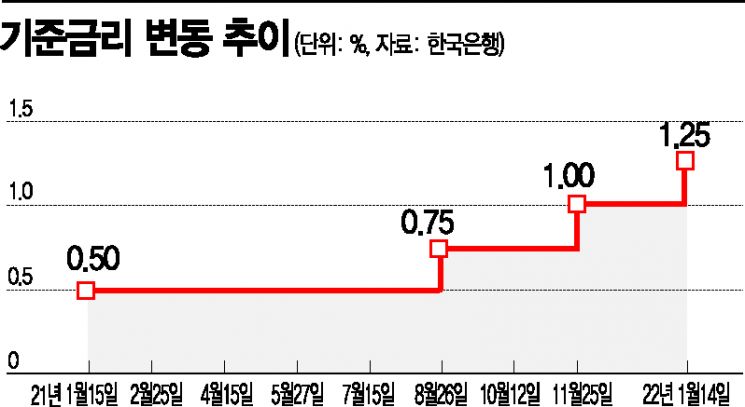

[Asia Economy Reporter Park Sun-mi] Following last week’s decision by the Bank of Korea to raise the base interest rate, KB Kookmin Bank and NH Nonghyup Bank increased the interest rates on their deposit products by up to 0.4 percentage points, resulting in all five major commercial banks applying higher interest rates on savings and installment savings products.

On the 19th, KB Kookmin Bank announced that it would raise the interest rates on 17 types of fixed and marketable deposits, including the Kookmin Super Time Deposit, and 20 types of installment savings, including the KB Dugundugun Travel Savings, by up to 0.40 percentage points starting from the 20th.

For KB Kookmin Bank’s non-face-to-face exclusive product, the KB Banryeo Haengbok Savings, the highest interest rate for a 3-year term will be adjusted to an annual 3.35%, and the KB Double Moa Deposit will change to a maximum annual rate of 2.05% for a 1-year term. In particular, KB Kookmin Bank will raise the interest rates on the KB Kookmin ONE Savings (fixed installment type), a representative universal product offering various preferential rates based on transaction performance, and the KB My Fit Savings, a product for young adults starting their careers, by 0.4 percentage points and 0.3 percentage points respectively.

A KB Kookmin Bank official stated, “We decided to raise deposit interest rates reflecting the Bank of Korea’s base rate hike and the rise in market interest rates,” adding, “We plan to continuously provide products and services that help KB Kookmin Bank customers build assets and manage their finances.”

NH Nonghyup Bank also decided to raise interest rates on savings and installment savings by up to 0.40 percentage points starting today. The general time deposit rate for deposits of one year or longer will increase from 0.95% to 1.20%, a 0.25 percentage point rise. Installment savings rates will also increase by 0.25 percentage points, changing the rates for products with maturities of one year or more from 1.20% to 1.45%. The product with the largest increase, the Jayuro Preferential Student Savings, will rise from 1.35% to 1.75% for deposits of one year or longer. The Sanghobugum will also be adjusted upward from 1.15% to 1.40%.

Earlier, Hana Bank sequentially raised interest rates on a total of 22 deposit products, including savings and installment savings, by up to 0.30 percentage points starting from the previous day. The base interest rates on seven major savings and installment savings products such as ‘Salary Hana Monthly Compound Interest Savings,’ ‘Main Transaction Hana Monthly Compound Interest Savings,’ ‘Naemam Savings,’ and ‘Hana Time Deposit’ were increased by 0.25 to 0.30 percentage points. The base interest rates on the remaining 15 savings and installment savings products will be raised by 0.25 percentage points starting from the 20th.

For the Energy Challenge Savings, the highest interest rate for a 1-year term will increase from 4.10% to 4.35%. For the Hana Travel Savings, the highest interest rate for a 1-year term will rise from 2.70% to 2.95%. For the Hana OneQ Savings, the highest interest rate for a 1-year term will increase from 2.60% to 2.85%. Each of these top rates is raised by 0.25 percentage points.

Shinhan Bank also raised interest rates on 36 types of fixed and installment savings by up to 0.40 percentage points. The representative product ‘Hello, Nice to Meet You Savings’ now offers a maximum annual interest rate of 4.4% for a 1-year term. The Shinhan Merchant Swing Savings, a product designed to help self-employed individuals save a lump sum, was raised to a maximum annual rate of 3.0% for a 1-year term. Additionally, the Shinhan My Home Savings for a 1-year term saw a 0.4 percentage point increase, changing the top rate to 2.6%. The interest rate on the 5-year maturity Future Planning Crevasse Pension Deposit for senior customers was also raised by 0.3 percentage points to an annual 2.15%.

Woori Bank raised interest rates on 18 fixed deposits and 20 installment savings products by 0.1 to 0.3 percentage points. The ‘Super Time Deposit’ interest rate increased from a maximum annual 1.45% to 1.7%, the ‘WON Savings’ rose from a maximum annual 2.5% to 2.6%, and the ‘Eussek (ESG) Savings’ product increased from a maximum annual 2.05% to 2.35%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)