[Asia Economy Reporter Ji-hwan Park] As South Korea approaches a super-aged society, an analysis has emerged emphasizing the need to prepare proactive strategies to meet the increasing demand for senior towns.

Samjong KPMG, in its report published on the 19th titled "Senior Towns, Seizing the Kairos Moment: Movements Preparing for a Super-Aged Society," analyzed domestic senior towns' trends in preparing for future society from three perspectives: location, medical and nursing care, and premium services. The report also proposed business strategies that should be adopted to evolve into next-generation senior towns.

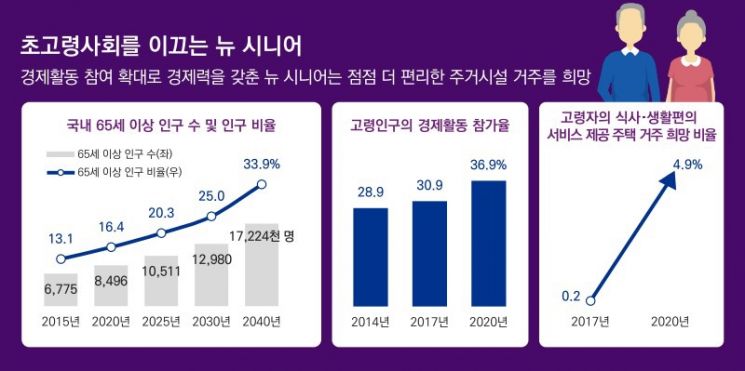

South Korea is on track to enter a super-aged society as the population aged 65 and over is expected to reach 20.3% by 2025. The new senior demographic shows different characteristics compared to previous generations. The new seniors anticipate a 100-year lifespan, plan their lives proactively, invest in themselves through consumption activities, and enjoy a wide range of leisure activities.

Senior towns focus on seniors' desire to age in place (AIP), meaning growing old in their own homes. There is a shift from locating in scenic outskirts to positioning senior towns within the areas where seniors originally lived. Senior towns situated in metropolitan or urban areas such as Seoul, Gyeonggi, and Busan, where many seniors reside, are gaining attention.

According to the 2020 Elderly Survey, 68% of seniors expressed a definite preference for medical-related services among paid services in senior towns. Senior towns are anticipating such demand by introducing specialized medical services such as health checkups, rehabilitation, and clinics, thereby driving demand expansion.

As seniors' economic power and desired living standards improve, services are also being upgraded. Beyond basic living services like well-being meals and housekeeping, premium services in various fields such as education, asset management, and financial consulting are being provided.

Samjong KPMG emphasized that, facing a super-aged society, senior towns must challenge change by establishing business strategies optimized for seniors. First, understanding seniors' AIP desires and considering urban locations are essential. It is also important to develop integrated community-themed senior towns that open private and public facilities to avoid being perceived as NIMBY (Not In My Backyard) facilities, or to create generation-integrated themes by operating kindergartens and children's sports centers together.

Additionally, while basic medical facilities and services are essential, there is a need to prepare differentiation by internalizing the highest level of medical technology available today. It was suggested that reviewing business linkages or cooperation with external specialized institutions and local governments could be helpful.

The report also forecasted that senior towns will attract attention as financial investment products. Healthcare sectors are already actively managed as REITs investment products in countries like the United States and Japan, and senior town REITs products are expected to show growth domestically in the near future.

Jin Hyung-seok, Executive Director of Samjong KPMG’s Corporate Real Estate Services Team, explained, "With changes in the new seniors' tendencies and increased economic power, demand for senior towns is rising. As well-operated senior towns are expected to benefit, it is time to explore new business opportunities by considering cooperation with external experts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)