[Asia Economy Reporter Park So-yeon] Commercial banks are considering downgrading the corporate credit rating of HDC Hyundai Development Company, which caused a major collapse accident in Gwangju. Credit rating agencies also plan to adjust the credit ratings for corporate bonds and project financing (PF), raising concerns that the company may face financial pressure.

According to the financial investment industry on the 19th, banks have begun internally reassessing the credit rating of Hyundai Development Company. Banks with significant credit exposure to Hyundai Development Company include KB Kookmin Bank, Woori Bank, and SC First Bank.

A senior official from a creditor bank’s corporate review department stated, "We have determined that Hyundai Development Company has significant management issues and are internally reviewing a credit rating downgrade," adding, "I believe all financial institutions are in a similar situation." He further explained, "Since a tragedy beyond common sense, including casualties, has occurred, the credit rating could drop by at least one grade and up to three grades."

Banks conduct their own credit rating evaluations to manage corporate credit risk. For externally audited companies, evaluations are conducted across categories such as industrial risk (industry-specific sensitivity to economic fluctuations over the next three years, growth prospects), operational risk (market position, market share, industry ranking), management risk (ownership and governance structure, management’s moral hazard), financial risk (proportion of short-term borrowings, sales trends, financial flexibility), and cash flow (interest coverage ratio, debt repayment capacity).

Starting with Bank A, other financial institutions are expected to follow suit with rating adjustments. Not only commercial banks but also credit rating agencies plan to reflect factors such as the company’s loss scale, brand reputation, and order competitiveness in their credit assessments. Korea Ratings announced on the 17th that it would review Hyundai Development Company’s credit rating. As of December last year, Hyundai Development Company’s credit ratings were A+ for corporate bonds, A+ for guaranteed bonds, and A2+ for commercial paper.

An industry insider from the financial investment sector said, "If a downgrade occurs, upon loan maturity, partial recovery or extension would involve a risk premium on interest rates," adding, "This could have a cascading effect on loan limits and corporate bond issuance rates, causing significant disruption to funding."

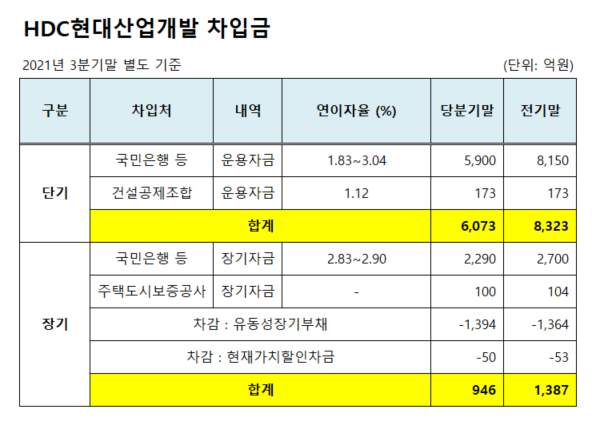

As of the end of the third quarter last year, Hyundai Development Company’s interest-bearing debt totaled 1.8755 trillion won. Short-term borrowings with repayment deadlines within one year to commercial banks such as Kookmin Bank amount to 590 billion won. Over the next two years, the maturity of PF securitized borrowings provided as credit guarantees for turnkey construction and payment guarantees by Hyundai Development Company will reach several trillion won. As of the end of the third quarter, Hyundai Development Company’s internal reserves (retained earnings) stood at 1.0923 trillion won.

New cash inflows from operating activities have also become difficult. With trust plummeting, risks of contract termination with construction companies and challenges in securing new orders are expected for the time being. Financial pressure related to responsibilities for the accident site is likely to intensify. The scale of the Gwangju Hwajeong I-Park project amounts to a total of 750 billion won, with sales of 492.5 billion won and contract value of 255.7 billion won. Korea Ratings projected that if complete demolition and reconstruction are considered, the legal and financial losses for HDC Hyundai Development Company will increase significantly.

Reporter Park So-yeon muse@asiae.co.kr

<ⓒ Asia Economy (www.asiae.co.kr), the window to the economy and the world. Unauthorized reproduction and redistribution prohibited>

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.