LG Household & Health Care, Notice of Designation as a Non-Compliant Disclosure Corporation

Celltrion, Agenda for Accounting Fraud Proposed

"Trusted as Industry Leader" Individual Investors Hit Hard

[Asia Economy Reporter Song Hwajeong] Stocks considered representatives of their industries are being embroiled in controversies one after another, unsettling the stock market atmosphere at the beginning of the year. Small shareholders who invested believing these were blue-chip stocks are restless.

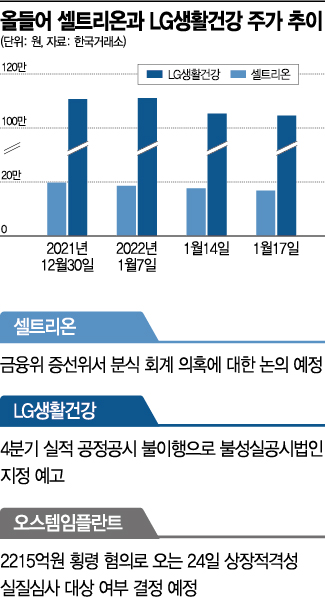

According to the Financial Supervisory Service's electronic disclosure system on the 18th, the Korea Exchange announced it would designate LG Household & Health Care as a non-compliant disclosure corporation. This is because LG Household & Health Care failed to make a fair disclosure regarding its operating results for the fourth quarter of last year. Some securities firms collectively lowered their target prices before the market opened on the 10th, citing that LG Household & Health Care recorded results below market expectations for the fourth quarter of last year. On that day, LG Household & Health Care's stock price fell more than 13%, breaking below 1 million won. According to the disclosure regulations of the Korea Exchange, information on sales, operating profit and loss, and net profit or loss must be reported to the exchange first. LG Household & Health Care explained that it provided some securities analysts with information that duty-free shop sales in December last year were temporarily almost non-existent regarding consolidated operating results for the fourth quarter of last year, but did not provide guidance on the overall fourth-quarter results. The exchange will decide on the designation as a non-compliant disclosure corporation, penalty points, and fines for disclosure violations after deliberation by the Market Disclosure Committee of the Korea Exchange.

Celltrion's stock price recently plunged sharply as the Celltrion accounting fraud agenda is expected to be submitted to the Financial Services Commission's Securities and Futures Commission (SFC) scheduled for the 19th. It is reported that the Financial Supervisory Service submitted an opinion to the SFC recommending prosecution of Celltrion's management. The final action plan regarding Celltrion will be confirmed after review by the Audit Committee, approval by the Securities and Futures Commission, and the Financial Services Commission. If Celltrion is ultimately found guilty of accounting violations, the Korea Exchange will conduct a review to determine whether it should be subject to a delisting suitability review.

Ostem Implant, which experienced an embezzlement case amounting to 221.5 billion won, equivalent to 108% of its equity capital, is scheduled to decide on whether it will be subject to a delisting suitability review on the 24th. If it is decided that it is not subject to the review, trading will resume from the 25th. On the other hand, if it is decided to be subject to the review, the trading suspension period is expected to be extended. If designated as a subject of the suitability review, the company must submit an improvement plan within 15 trading days, and the Korea Exchange will hold a corporate review committee within 20 trading days based on this to decide whether to maintain listing, delist, or grant an improvement period. The improvement period is within one year, and if granted, trading suspension could last up to about one year.

Individual investors who invested in these stocks, considered representatives of their industries, have been hit hard. Celltrion's stock price fell more than 12% on the 14th, dropping sharply to the 160,000 won range. It hit a 52-week low of 159,500 won during the previous day's trading session. LG Household & Health Care, which fell from its status as a blue-chip stock due to concerns over poor earnings, is also expected to experience a sluggish trend for the time being amid worries about poor performance and the risk of being designated as a non-compliant disclosure corporation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.